U.S. data

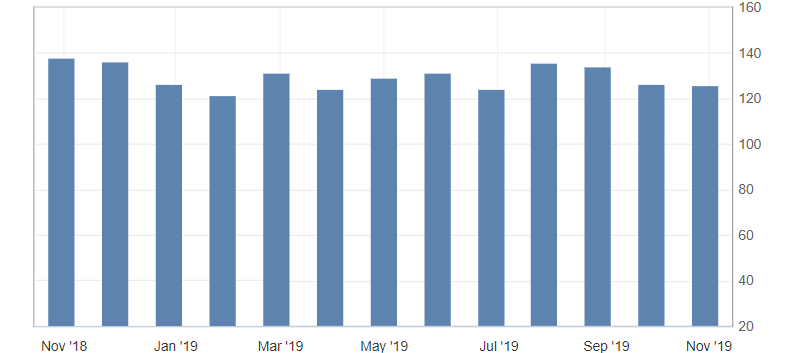

- CB Consumer Confidence Index (Oct), fact 125.9, forecast 128.0.

- Pending sales (m/m) (September), fact 1.5%, forecast 0.9%.

Published data for the United States turned out to be multidirectional. Thus, consumer confidence in the United States slowed down in October, which in the end can be regarded as a negative indicator of sales for consumer inflation. Especially given the signs of a slowdown in the shopping period.

Fig. 1. U.S. CB Consumer Confidence Index Chart

Weak consumer confidence data increased pressure on the US dollar, increasing the decline in the US dollar index against a basket of competitors, which at the same time remains limited by market restraint. Given the multidirectional tendering and the expectation of significant data for the United States, the dynamics of the American dollar will remain limited. Support levels: 97.70-60, resistance: 97.90-98.00.

Fig. 2. The US dollar index chart. Current price – 97.70 (10-year US government bonds yield – blue line)

Read also: “Currency is a weapon in a trade war!”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- An uncertainty about Brexit is increasing

- Aggravation of the US – eurozone trade tension

- USD/CNY – an indicator of the progress of the US – China trade relations

Current Investment ideas: