US retail sales data

- Core Retail Sales (m/m) (June), fact 0.4%, forecast 0.1%.

- Export Price Index (m/m) (June), fact -0.7%, forecast -0.2%.

- Import Price Index (m/m) (June), fact -0.9%, forecast -0.7%.

- Retail sales (m/m) (June), fact 0.4%, forecast 0.1%.

Retail sales in the US increased in June, which caused a slowdown in this indicator. And what is important, they pointed to the preservation of the upward dynamics of consumer inflation.

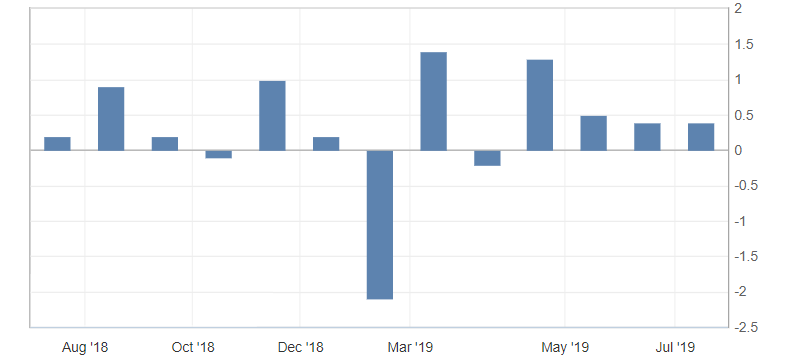

Fig. 1. Core index of retail sales in the United States

Against the background of the collapse of European currencies, the US dollar received additional support from signs of rising inflation in the United States. The US dollar index has updated a low at 97.30, which was largely due to the decline of the euro and the pound. But the American dollar, in turn, turned out to be significantly overbought, which will limit its growth to positive data. The significant resistance level is the level of 97.30-40, from which we can expect a low-key correction.

Fig. 2. The US dollar index chart. The current price is 97.30 (10-year US government bonds yield is the blue line)

Read also: “The main factors of influence on the currency, stock,

crypto-currency market. Choose the best tool for trading”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- The trade war. Relations between Japan and South Korea

- The Japanese yen: expectations and prospects.

- US and China return to the negotiation table

Current Investment ideas: