U.S. Inflation Data

- Core Consumer Price Index (CPI) (m/m) (June), fact 0.3%, forecast 0.2%.

- Core Consumer Price Index (CPI) (y/y) (June), fact 2.1%, forecast 2.0%.

- Consumer Price Index (CPI) (m/m) (June), fact 0.1%, forecast 0.0%.

- Initial jobless claims, fact 209K, forecast 220K.

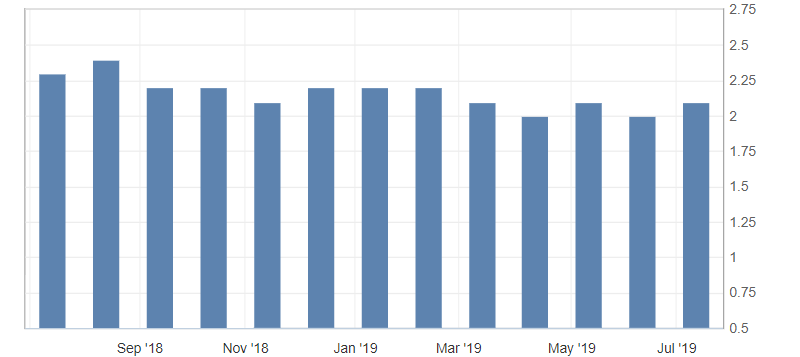

Data on the US inflation for June exceeded market expectations, showing a moderate increase in consumer inflation, despite the negative expectations of the US Federal Reserve. The number of initial claims for unemployment benefits also decreased, indicating a positive trend in the US labor market. It is worth noting core consumer price index (CPI) (y/y), which slowed down the downward trend.

Fig. 1. Core consumer price index (CPI) (y) USA

Despite the positive inflation data, the dynamics of the US dollar remains limited by the comments of the US Federal Reserve Chairman. In the end, it had a deterrent effect on the American dollar. Thus, the US dollar index is limited by the downward trend and resistance levels: 97.00 and 97.20.

Fig. 2. The US dollar index chart. The current price is 96.90 (10-year US government bonds yield is the blue line)

Read also: “The medium-term prospects for the US dollar for August-September”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- US and China return to the negotiation table

- Cryptocurrency market continues the growth data on Libra

- OPEC + Market expects continuation of agreement to limit production

Current Investment ideas: