Inflation Data in Canada

- Core Consumer Price Index (CPI) (y/y) (September), fact 1.5%, forecast 1.8%.

- Core Consumer Price Index (CPI) (m/m) (September), fact 0.0%, previous value 0.1%.

- Core Retail Sales (MoM) (Aug), fact -0.4%, forecast 0.2%.

- Consumer price index (CPI) (m/m) (September), fact -0.4%, forecast -0.1%.

- Retail sales (m/m) (aug), fact -0.1%, forecast 0.3%.

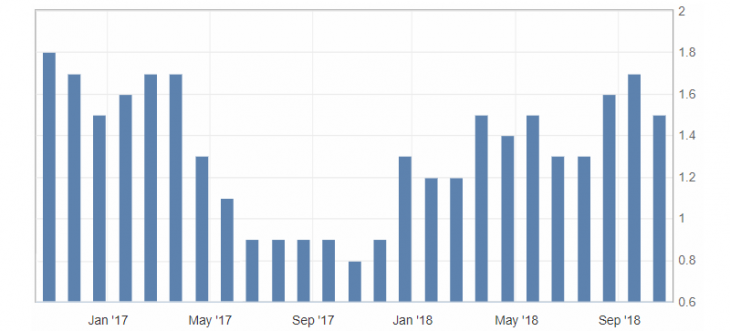

An inflation report in Canada was negative in all respects and it caused a significant decline for the Canadian dollar. Consumer price index (CPI) (y/y) especially slowed down and returned to the levels of May of the current year .

Fig. 1. Core Consumer Price Index (CPI) chart

An inflation report in Canada was considered too acute because next week a meeting of the Bank of Canada will be held. It is expected to raise the key interest rate. In light of this report, the likelihood of higher rates of the Central Bank of Canada has decreased markedly.

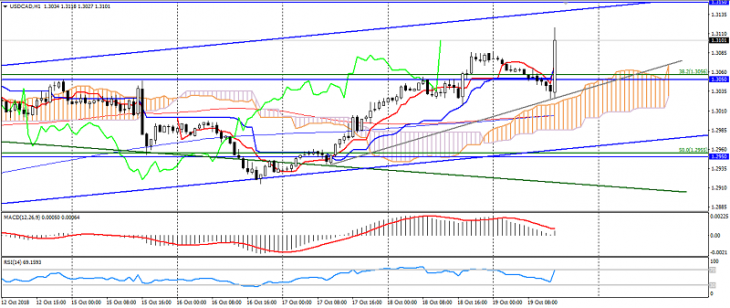

As a result, the USD/CAD pair has updated a month high, confirming the upward trend in the pair. The main resistance is located at levels: 1.3120-30 and 1.3150, support: 1.3150-70 and 1.3030.

Fig. 2. USD/CAD chart. The current price is 1.3100.

Read also: “5 candlesticks pattern rule. Candlestick analysis”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- The US economy continues its growth, confirming the rates hike policy.

- Prospects for recovery of emerging markets.

- Trump presidency results (1/2).

Current Investment ideas: