The “sunset” sentiments of the quantitative easing policy from the Bank of Japan. Weekly review of the pair USD/JPY.

Good afternoon to all participants of exchange trade. With you, Andrew Green – financial analyst of the international currency market ForEx.

Last Friday was filled with events not only of American and European markets, but also added a reason to think for lovers of Asian quotations. The European morning of Friday pleased us with the publication of data on the social sector of Japan, namely the data on unemployment, which came out at 2.4%, which is 0.4% lower/better than expected and the previous value of this indicator. In addition to these data, the index of consumer prices in Tokyo was also positive – 0.9%, 0.2% better than the previous value and 0.1% better than the forecast. Thus, we see the continuing dynamics in the Japanese economy for growth and rising inflation expectations.

After such indicators, there was no time to wait and the press conference of the current Head of the Bank of Japan – Haruhiko Kuroda. Here it is time for the most interesting on this day. From what he said it is worth highlighting several main, acting on the prospect, theses:

- Further growth of wages is necessary to increase inflation, and we are talking about growth at the level of 3%;

- For a long time, the influence of the Bank of Japan on regional banks will remain significant;

- The policy of the Bank of Japan will not remain unchanged for a long time;

- The Bank of Japan focuses on prices, but this does not mean that it ignores unemployment data;

- High probability of achieving the necessary inflation levels in 2019;

- The Bank of Japan plans to withdraw from the state of zero levels of the discount rate in 2019.

- After a long period of “pigeon” rhetoric of the Bank of Japan, even such minor statements on the tightening of monetary policy make you think and carefully revise your list of reserve currencies.

The Japanese yen is still one of the main instruments-shelters for the world financial arena. Against the backdrop of growing risks from US policy of protectionism, geopolitical conflicts in the Near East, periodic trade confrontations on global commodity and capital markets, the yen holds a fairly strong position in investment portfolios and in the hedging structure of international financial organizations.

To a large extent, Japan’s economy is export-oriented and the Bank of Japan was one of the first to apply zero reservation rates for these reasons and is likely to be one of the last to withdraw them. Such rhetoric of the main acting Speaker of the Bank of Japan, even without proper accents, should cause some thoughtfulness and correction of the basic strategies for this instrument.

In simple words: the Bank of Japan (BJ) is interested in a weak national currency, to protect the interest of the national producer in the international arena. In the past, the BJ has repeatedly applied one-time currency interventions in the market to stabilize the exchange rate of the national currency at times of peak demand amidst panic movements of investors. And now it itself forms a light background for the strengthening of the national currency, creating, so far, minor, accentuations on the further curtailment of the zero-credit policy. It’s hard for me to understand the reasons for this change of rhetoric at this stage, but this does not mean that you should not pay attention to it.

Let’s take a look at the current situation with the help of technical analysis to clarify the prospects and possible options of the situation development for the USD/JPY pair.

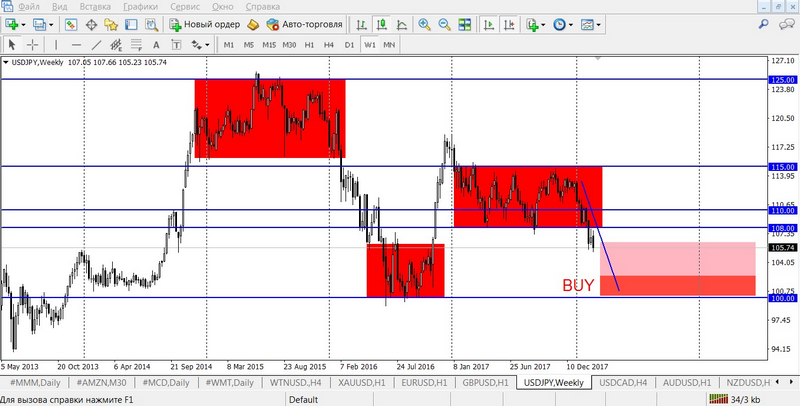

Let’s start, perhaps, with the figure 1 – analysis of the weekly timeframe and long-term trade.

We have a clear breakdown and a re-test of 108.00 with a clear prospect of further shifting to the lower flat range of 100.00 – 105.00. The analysis and trading perspectives of these time intervals are a tool for hedging and portfolio investment, in a word, for a long period it is worth increasing the percentage of the Japanese yen in your savings and assets. For traders, it is more practical to analyze the average and short trading periods.

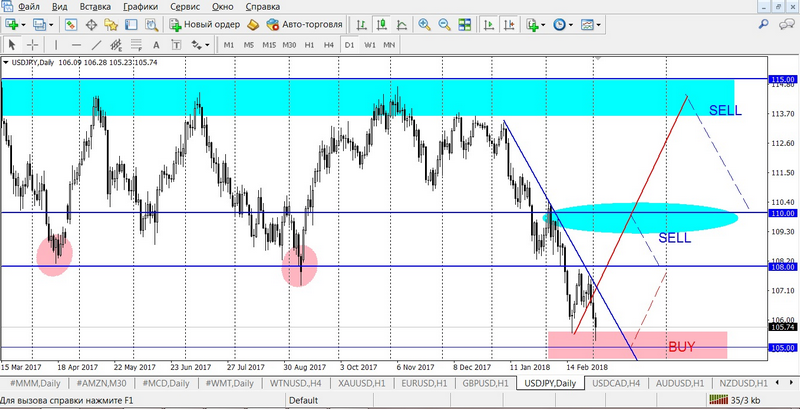

We go deeper, and look at figure 2 and day timeframe, the most in demand among strategic planning in the international currency market.

As we can see, the pair is approaching a strong psychological level at 105.00 and there will be a real short-term correction from this level, but to trade for a purchase with such an abundance of factors in support of the yen is only for fans and craftsmen of aggressive trade. This requires a clear control of the volume, the speed of decision-making, confident management of the security of assets. For non-professionals, I recommend that you consider a more relaxed sales option from the levels of 110.00 and 115.00.

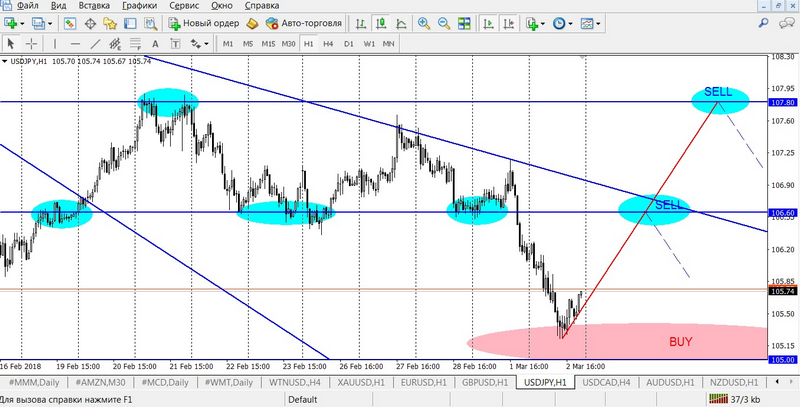

Short-term trade begins on H1. And, to your attention, figure 3.

Here you can see all the same support at 105.00 for aggressive purchases. As for sales – here the story is more interesting. You can notice a very interesting zone around 106.60 with multiple confirmations of both support and resistance in this range. This level is very promising for aggressive selling. And the next level, for quieter sales, at 107.80 – the highs of the last decade of February 2018.

Examples of transactions:

- conservative option:

SELL limit 107.80, SL 108.40, TP 107.20 - aggressive option:

SELL limit 106.60, SL 106.90, TP 106.10

BUY limit 105.20, SL 104.80, TP 105.90

A hot heart that aspires to new heights, and a cold mind that evaluates prospects and controls risks is an anatomy of success in the financial market.

Andrew “Golden Eye” Green