Japanese Yen (JPY) – Features of trading on crosses. Anton Hanzenko.

Discussing the topic of cross-rates, it is worth to single out the trade on crosses in which there is a Japanese yen (JPY). The high volatility of these crosses and the continued stability of existing trends can be an excellent tool for earning. But, due to high volatility and low predictability, cross-rates with yen may contain significant risks, which will be discussed below.

Let’s have a closer look at Japanese economy and yen

Japan’s GDP ranks fourth in the world. Japan has the highest level of employment and the highest technological development. The policy of the central bank (Bank of Japan) focuses on negative interest rates. So, since 2016, the Bank of Japan has kept the interest rate at around -0.1%. The main policy of the Bank of Japan is aimed at a high level of competitiveness in the external market, which is caused by the struggle with strengthening the yen and low inflation. The Central Bank of Japan often resorts to intervention both verbally and to repay long-term government bonds.

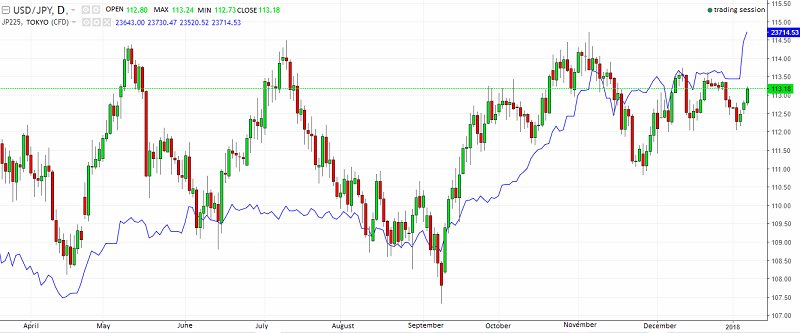

Also, the Japanese yen is an asset of a safe haven, which, in case of an increase in global risks, may cause the strengthening of the yen. The pair USD/JPY well correlates with the Japanese index Nikkei 225.

In addition to the fact that the Japanese yen is an asset of a safe haven, it is necessary to distinguish such features:

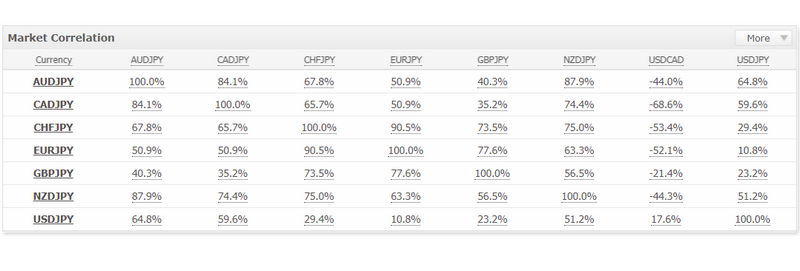

Cross-rates with a yen have a very high level of correlation between adjacent (unidirectional) currencies, such as AUD and NZD; EUR and CHF. This may be applicable in the correlation strategy.

The second significant feature of crosses containing yen remains the preservation of global trends, which, despite the considerable volatility, remains very stable. As a result, breakout strategies are used at large timeframes.

The second significant feature of crosses containing yen remains the preservation of global trends, which, despite the considerable volatility, remains very stable. As a result, breakout strategies are used at large timeframes.

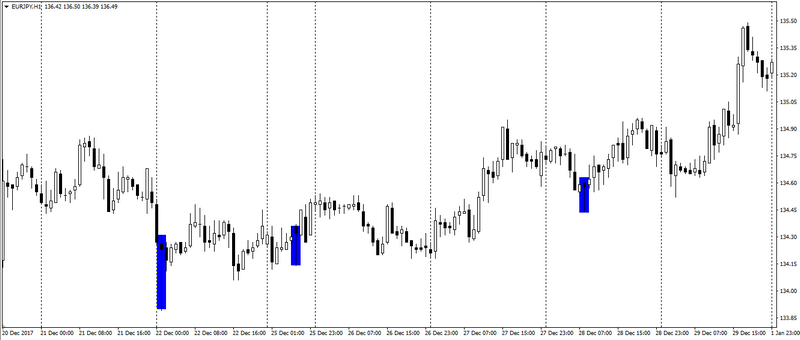

On junior timeframes crosses with a yen are characterized by a high number of shadows or pins, which indicates a false breakout and reversal motion patterns, such as pinball and others.

Of the minuses and dangers hidden by crosses with the yen, it is worth highlighting a relatively high unpredictability, especially within the trend. Crosses with a yen have a lot of spikes, which can cause losses when trading with small stops. Therefore, when trading the yen, as with most cross-rates, special attention should be given to protective orders and money management.

A significant shortage of crosses containing yen is their low activity in different sessions and an ambiguous reaction to the news. So, if EUR/JPY and GBP/JPY are actively traded in European and American sessions, then AUD/JPY and NZD/JPY are mostly traded in Pacific sessions.

This is a small list of trading features on cross-rates containing Japanese yen. More information about the crosses and not only you can learn from the training courses.

Anton Hanzenko