Amazing AMAZON. Analysis of prospects in anticipation of the report.

Hello, everyone! With you, the permanent observer of the financial market stars Andrew Green.

Today we are waiting for an exciting review and study one of the comets in the sky of the American stock market, rushing like a meteor the online trade operator, and in fact the best friend of the end user in the US – the company AMAZON.

Amazon.com, Inc. – (AMZN: NASDAQ) is an American company, the largest in the world in terms of turnover among products and services sold through the Internet and one of the first Internet services aimed at selling real goods of mass demand. Headquartered in Seattle, Washington.

Amazon.com was created in 1994 by American entrepreneur Jeff Bezos, and in 1995 the site was launched. The company was named after the Amazon River, the most abundant in the world. Initially, only books were sold on the site. In June 1998, the store began selling music CDs, and in November of the same year – video products. Later in the range there were MP3-records, software, video games, electronics, clothes, furniture, food and toys.

Currently, Amazon.com service covers 34 categories of goods, including e-books, consumer electronics, children’s toys, food, household goods, sports goods and much more.

This company also has branches outside the United States, in Brazil, Canada, Britain, Germany, Japan, France, Italy, Spain, India and China.

(WIKIPEDIA)

I think that for many, it’s not news that our world is filled with different templates, which often form our opinion and our actions. We love bright images, we like the hep-ends and images of the “American dream.” AMAZON company is a bright option of the “American dream” in the financial market. Starting on the NYSE in 1997 with a price of 28 USD per share, the company has now reached the milestone of 1400 USD. Just a dream for every investor – to return in 1997 and invest in it. Then the events of last winter come to my mind, when I kept on my balance 3000 shares at 820 USD. Then, due to the uncertainty after the elections on the market , the stocks rebounded to 800 USD, I stocked up with patience and in April sold the asset, as it seemed the maximum at that time – 950 USD.

How do you think, watching now the price of 1400 dollars whether I feel sorry that I did this way?

Of course, yes ….

As traders, we sometimes have to make decisions about selling even very profitable assets in order to continue to take a really active position and trade. Of course, if you are an investor, you can afford long-term retention, but a trader is another story. The potential of trading is much higher than any expectations of investors. But this is a separate topic. The publication of an article on this topic – “Investor and trader. Conflict or partnership?” expect in the near future in the section “Trader’s blog” on the site of my partner and your broker Ester Holdings Inc.

What to expect next? Analyzing the price chart for the entire period (Figure # 1), it seems that you are looking at launching a space rocket).

But we know one of the key laws of the financial market: the price can not always move up, sooner or later there will be a reversal, or at least a correction. Also it is necessary to understand, on what to count in the near future:

- Creation of the second headquarters AMAZON (HQ2). There is a real confrontation between the cities. In the main race involved: Dallas, Atlanta, Baltimore, Philadelphia, Nashville, Newark and another dozen cities across the US. What is so attractive for cities in the creation of HQ2: 50,000 jobs, more than 5 billion investments in the development of infrastructure and logistics, the cumulative development of satellite businesses in the retail trade. In fact, such an enterprise for any region becomes a city-forming and a point of explosive development. As for the dynamics of the share price in connection with this news, I personally expect a decrease in dividend payments in 2018, due to capital investments in the development of this project. But not the fact that this will affect the overall dynamics of the course.

- Development of the AMAZON GO project – supermarket chains without cashiers. Taking into account modern information technologies, the possibility of successful implementation of this project is VERY HIGH. And this is a separate niche in retail, which can become an easy prey for the giant of online trading.

- The purchase in 2017 of Whole Food and a partial change in the company’s goals with a reference to retail trade, but not at the expense of online trading.

- In 2018, a 30% increase in cash revenue is expected, and a basic benchmark for a possible maximum price in the region of 1800 USD per share.

Yes, I did not see such a positive mix for a long time. But there is one spoonful of tar that spoils a barrel of honey. The very fact that the price for the year has grown by almost 80% (if taken at the starting price of the beginning of the year) implies a serious overbought.

What to do?

Trade recommendation – buy after correction

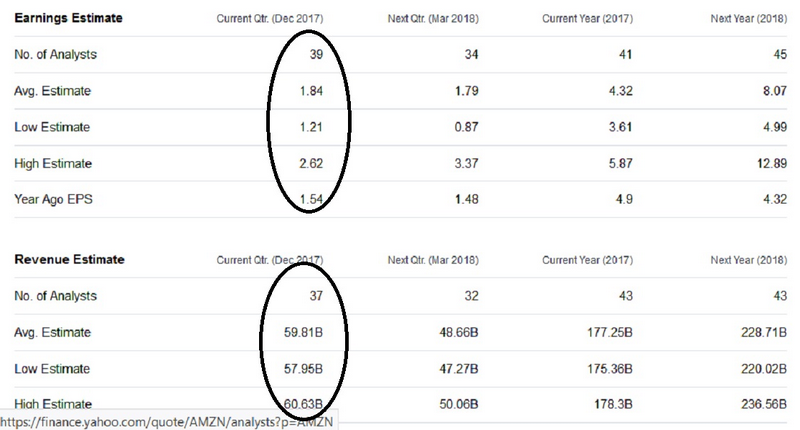

February 1, we are waiting for the report on the results of 2017. Most likely, there will be everything just super (Figure #2). The forecast of 39 analysts for further growth of earnings per share and total revenue for the year.

But after a breakthrough last week, a normal pullback to support levels around USD 1375-1380 is still possible. You can see more clearly in Figure # 3.

Examples of transactions:

- conservative option:

BUY limit 1375.00, SL 1340.00, TP 1490 (short-term option)

BUY limit 1375.00, SL 1290.00, TP 1600 (long-term option) - aggressive option:

BUY 2nd volume (from the opening of the market on Monday, 29 Jan),

SL 1290, TP 1490 (1st volume) +1600 (2nd volume)

If you have any questions on the recommendation, or have additional information on the analysis of this financial instrument, I will be glad to talk with you. Write to the technical support address of the Ester support@esterholdings.com with a note for Andrew Green.

You know, there is such a phrase – “Dreaming is not harmful” … I will add from myself: “Harmful – not to dream.”

Dream, set goals – reach them. This is what life is all about.

Andrew Green