Friday trades: features and patterns.

While trading in the Forex market, you can notice that the activity on the market day by day can vary significantly. There are many reasons for this: news publications, weekends on stock exchanges and unexpected statements. There is also a cyclical pattern and trading on Friday is one of it.

Essentially, Friday trades are very complicated due to the filling of a number of influence factors, more difficult than in the middle of the week. Therefore, on Friday you should work more carefully.

Features and patterns

One of the features of Friday trades is the reducing of trading volumes. It happens because many traders prefer to close positions before the weekend in order to avoid risks from the upcoming news on the weekend. So, you can avoid the consequences of gap formation.

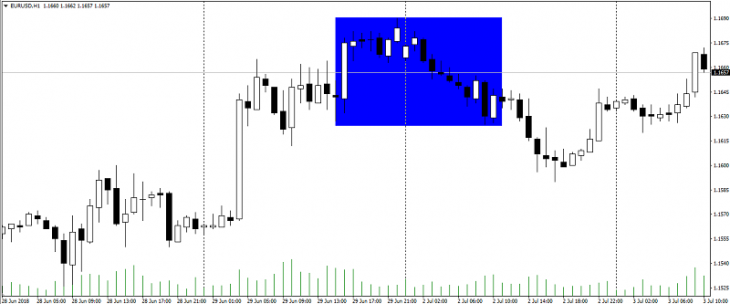

Fig. 1. EUR/USD chart. Gap on the weekend.

The picture shows an example of a small gap, about 20 points, but even it can cause the closing of the transaction with loss. At the same time, the size of the gap largely depends on the significance of the news that came out at the weekend.

Leaving this pattern, the daily trend towards the end of Friday can slow down significantly or change completely.

Fig. 2. EUR/USD chart. Change of trend on Friday

Also, the strength of the market movement in the correction for positions depends to a large extent on the end of the month and quarter. It makes this movement stronger due to the fact that traders are preparing for monthly and quarterly reports.

There is something called “movement against Friday”, and it is also a feature of Friday trades, but it refers to Monday.

Fig. 3. EUR/USD chart. “Movement Against Friday”

If a strong stable trend is observed on Friday trades, then there is a high probability that a correction against this movement will be observed on the market on Monday. “Movement against Friday” is a kind of correction that has much in common with a typical corrective movement after growth or decline. But the “movement against Friday” can be more significant than the usual correction as a rule.

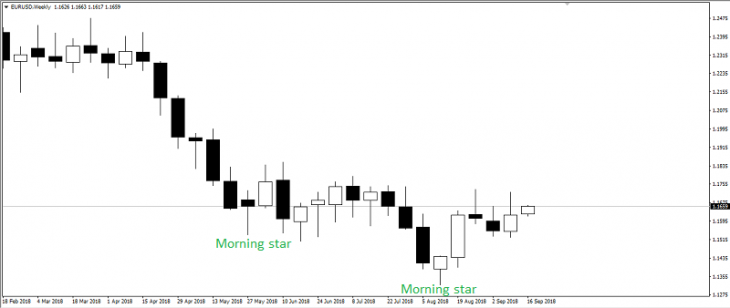

In addition to the fact that Friday trades can take place according to a certain pattern, closing Friday can give an idea of the movement next week. As the weekly candlestick closes on Friday, which is applicable for trading with candlestick formations.

Fig. 4. EUR/USD (W) chart. Candlestick formation “Morning Star”

Other Japanese candlestick formations can be applied.

Given these nuances, Friday reades can become not only more safe, but also more profitable.

Anton Hanzenko