The US mitigates the positions on foreign investment!

The US mitigares the positions on foreign investment. Thus, at the end of June 2018, D. Trump announced that he wouldn’t resort to an act of emergency international economic powers of 1977. In the end, this caused a reduction in risks around the tensions associated with Chinese investments aimed at obtaining patent rights belonging to the states.

At the same time, the powers of the Committee on Foreign Investments of the United States (CFIUS) were expanded, which should be a worthy rebuff in the acquisition of American technologies by China.

This decision provided significant support to the American dollar and significantly reduced the risks associated with the US trade war, which caught not only China. But, the US trade confrontation remains in force as the market reaction to the value of the dollar showed.

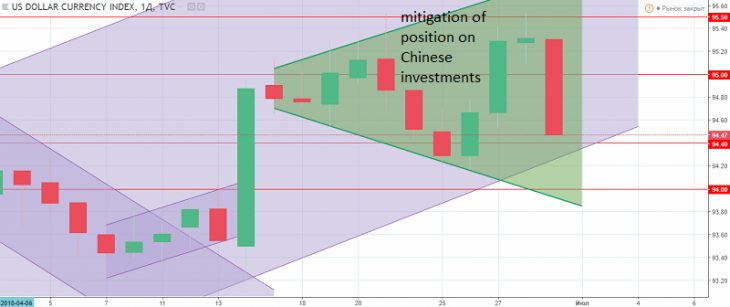

Fig. US dollar index Graph

At the same time, the subsequent correction on Friday indicates the preservation of negative sentiments about the US currency. And technically, the US dollar index forms a reversal pattern, which in the future can indicate a reversal of the general uptrend.

Despite the fact that the states left the opportunity for Chinese investment, the investment from China at the beginning of 2018 is 1.8 billion dollars, which is slightly more than a tenth part of investments for the same period last year.

Therefore, this decision is largely dictated by the need for investment in the American economy, and not by copyright protection behind which the White House administration veils.

On the other hand, America’s trade confrontation has exacerbated the relationship with the euro zone. So, duties on cars with the EU can completely spoil relations between the US and the EU, the main world economies. And if the states begin to back out against China, thus expecting a resumption of investment, the rejection of European investment could render irreparable damage to the US economy.

In addition to investment and international relations, which have already suffered from the trade confrontation of Trump, US stock indices remain under considerable pressure. They are not only an indicator of the growth of the states, but also of the world economic climate.

As a result, the mitigation of foreign investment positions in the United States of America can be viewed in different ways, but the fact that the US trade confrontation has begun to drive itself into a dead end will not be disputed. The question remains open as to how long the flight will go into emptiness, and what will become an irreversible factor that will force is to reconsider its actions.

Anton Hanzenko