The state of the Asian market: the US dollar is trying to get off the flat

At the beginning of the day, there is a certain increase in optimism after yesterday’s trading, which is expressed by a new wave of strengthening of global stock indices. The growth of optimism largely depends on the duration of the growth of stock indices and the absence of negative factors.

So, after the data that the ruling party of Germany failed to create a coalition, the probability of a new parliamentary election in Germany has sharply increased. The single currency reacted to this with a very restrained decline. It is not known for sure yet whether the new parliamentary elections will take place in Germany or German Chancellor Merkel will still manage to create a ruling coalition.

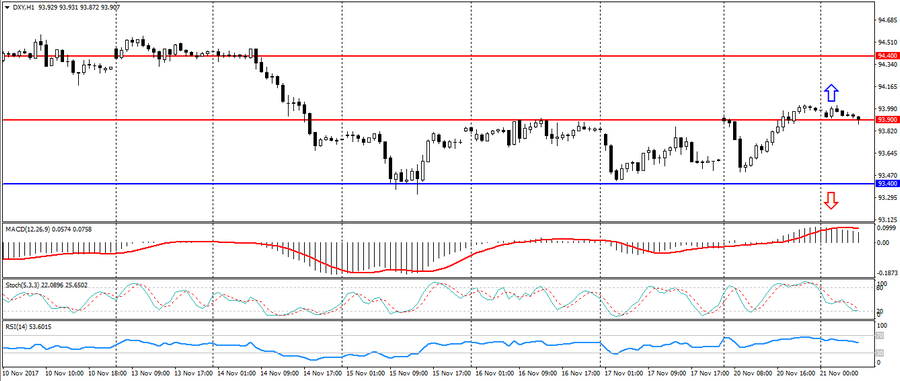

As a result of growing political risks in Germany, the US currency managed to gain a little strength against its main competitors in switching attention from the political crisis in the States. So, the US dollar index was able to update a maximum of four days at around 94.000, which indicates the expansion of the trade channel, but does not give hints of further strengthening of the American. As a result, the dynamics of the US dollar index continues to be a limited by a lateral trend, which was mentioned earlier …

Hanzenko Anton