Swiss franc (CHF) – features of trading on cross-rates. Anton Hanzenko.

When trading on cross-rates, you can not pay attention to the Swiss franc, which, unlike most crosses, is very stable. Franc can serve as an excellent beginning for novice traders who are only discovering cross-rates.

Data on the Swiss economy

The Swiss economy is one of the most stable in the world, as indicated by Swiss banks and stable economic growth rates. Probably, there is not a single conscious person who would not have heard of a Swiss bank or watch.

The policy of the Swiss National Bank (SNB) is aimed at long-term monetary stimulation. The ultra-low interest rate in Switzerland meets -0.75% since January 2015. In recent years, investments in Switzerland have declined markedly due to ultra-soft monetary policy and significant development of the economy of this country. At the same time, Switzerland’s GDP growth rates are very high and maintain a steadily positive dynamics.

The main event in the modern Swiss economy was the franc withdrawal from the euro, which took place on January 15, 2015. As a result, the Swiss franc updated historic highs against its main competitors. This increase in the franc formed a trading range, in which most of the main crosses are traded so far.

Swiss Franc – Features of Trade

The Swiss franc on the world financial market is the currency of a safe haven. Along with the Japanese yen and gold, but inferior to them because of the restraint of the Swiss Central Bank. In this case, the popularity of the franc as a safe asset increases significantly during periods of verbal intervention of the Japanese yen.

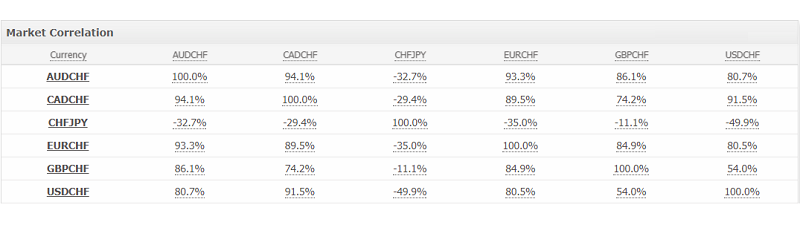

Also, the franc is highly correlated. Thus, the pair USD/CHF and the Swiss SMI index have a high degree of direct correlation.

Regarding currency pairs, CHF also has a high degree of correlation, which is applicable in trade.

Also, in the trade of the Swiss franc, it is worth noting its low susceptibility to Swiss data, if they do not have unexpectedly high or low rates. This is due to the very stable growth of the Swiss economy.

The Swiss franc is highly prone to trade in canals, which is expressed by the continued safety of unidirectional trends. Also, the franc is has a very low volatility with high liquidity, which will significantly reduce the risks when trading in cross-rates. CHF is considered a very calm currency due to the long movement of pairs containing francs in flat, which confirms the applicability to this currency of tactics based on channel trading.

In general, the Swiss franc (CHF) is mainly traded in channels and has relatively low volatility in comparison with most cross-rates. In this case, the franc is the currency of the safe haven.

Anton Hanzenko

Read the same previous articles on this topic:

Euro (EUR) – Features of trading on crosses. Anton Hanzenko.

British Pound (GBP) – Features of trading on crosses. Anton Hanzenko.

Japanese Yen (JPY) – Features of trading on crosses. Anton Hanzenko.