Развивающиеся рынки и их перспективы: Российский рубль (RUB)

Одним из ярко выраженных развивающихся рынков остаётся российский рынок. При этом данная экономика относится к развивающимся рынкам. С другой стороны торговля на русском рубле не такая простая, как может показаться на первый взгляд и поэтому российский рубль (RUB) не подойдёт для начинающих трейдеров.

Экономика России

Экономика России занимает 6 место в мире по объёму ВВП. Относительно номинального ВВП Россия занимает 12 место в мире. Основной статьёй дохода бюджета страны остаётся экспорт энергоносителей, нефти и газа. Это делает российский рубль сырьевой валютой. Также недра России богаты другими металлами, которые занимают значительную долю экспорта страны.

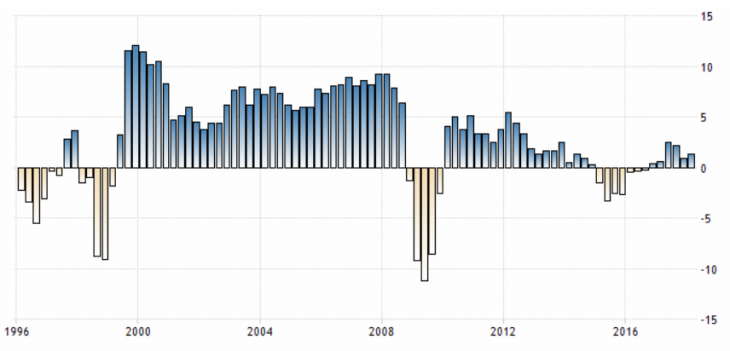

Рис. 1. Темпы роста ВВП России (г/г)

При этом стоит отметить, что экономика России в большей мере опирается на экспорт ископаемых ресурсов, что делает данную экономику более сырьевой, чем остальные. То есть зависимость российского рубля от динамики сырья и непосредственно нефти более значимая, чем у остальных сырьевых валют с рыночной экономикой.

Вторым значимым фактором влияния экономики на динамику рубля остаётся геополитика и риски, связанные с ней. Россия является крупным геополитическим игроком. И в силу разных обстоятельств часто выступает фигурантом тех или иных событий, что сказывается на динамике рубля, на международном финансовом рынке.

Основным показателям популярности рубля и соответственно его востребованности выступают иностранные инвестиции в экономику России. Данный показатель определяется несколькими метриками, такими как: иностранные инвестиции, деловое доверие и комфорт ведения бизнеса.

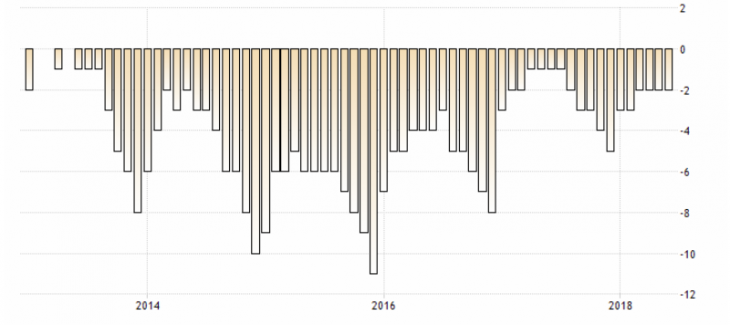

Рис. 2. График делового доверия в России

В силу геополитических рисков данные показатели остаются весьма слабыми, что обусловливает общую нисходящую динамику русской валюты.

Корреляция рубля

Поскольку российский рубль это сырьевая валюта, он в значительной мере привязан к динамике нефти. Принято проводить параллель с рублём и маркой нефти BRENT.

Рис. 3. График пары USD/RUBи нефти BRENT (синяя линия)

При этом динамика рубля может расходиться с динамикой нефти в силу геополитических событий или фундаментальных факторов, таких как заявления ЦБ России и публикации влияющей статистики.

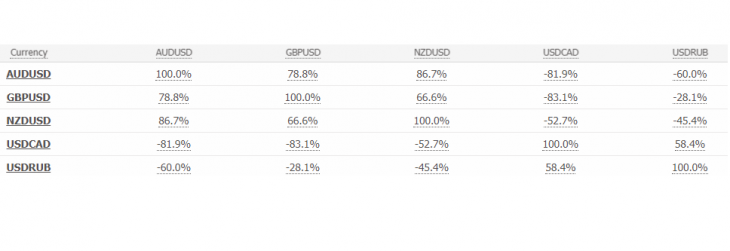

С другими мировыми сырьевыми валютами российская валюта имеет незначительную корреляцию, но она есть. И данная корреляция заметно выше в периоды политического затишья.

Рис. 4. Таблица корреляции

Итог

Российский рубль — весьма сложная валюта для торговли, помимо плавающих свопов и зависимости от политических рисков, что делает данную валюту очень сложной для начинающих трейдеров.

При этом, как и большинство валют развивающейся экономики, она хорошо коррелирует с нефтью, что может послужить отличным индикатором для торговли рублём. Но, из-за нестабильности и подверженности политическим рискам, стоит обращать внимание на политические риски.

Не все тактики подходят для рубля, в основном для рубля используют трендовые стратеги. Эффективность, которых может снижаться на переменной волатильности валюты.

Антон Ганзенко