Candlestick analysis. The main candlestick patterns. Part 3. Alexander Sivtsov.

We continue to get acquainted with the main reversal candlestick patterns. This time it will be about engulfings, as well as about such candlestick patterns as the dark cloud cover and the piercing pattern.

The main candlestick patterns: Engulfing

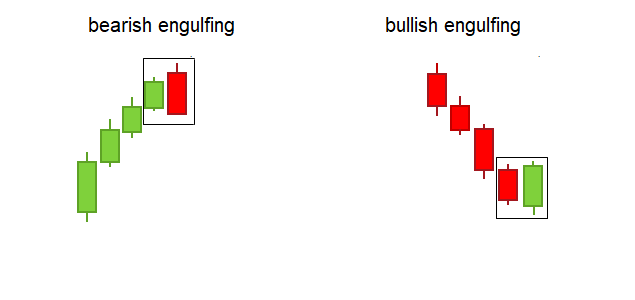

Engulfing is one of the most common candlestick patterns. There are two types of engulfing: bearish and bullish.

The combination is formed from two oppositely directed candlesticks, while the second candlestick is formed in the opposite direction and overtakes the previous one with its body.

Terms of the engulfing pattern formation:

1.) Clear directional movement in the market, ascending or descending.

2.) Formation a pattern in which the body of the next candle engulfs the body of the previous one.

3.) Both candles are multidirectional, with the first candle characterizing the current movement in the market, while the second candle will signal about new trend.

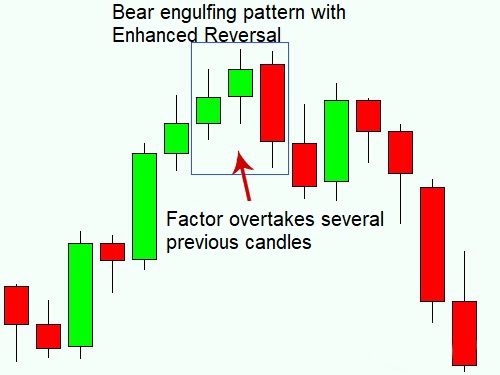

These patterns will be stronger in several cases:

1.) The body of the engulfing candle exceeds the body of the first candle several times, while the body of the first candle is rather small, which is an additional signal for the attenuation of the current trend.

2.) Upward or downward movement in the market before the formation of the engulfing should be as strong as possible, since any impulse ends sooner or later.

3.) Multiple engulfing is characterized by the fact that the engulfing candle covers the body not only with the previous candle, but also with several earlier ones.

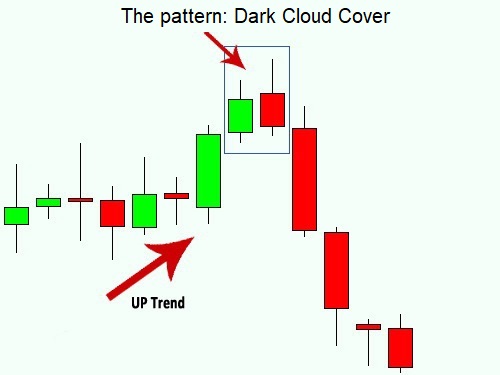

The main candlestick patterns: Dark Cloud Cover

The dark cloud cover is a candlestick pattern, which is formed after a strong upward movement in the market. As a rule, this model is strong and can lead to a sharp change in the price movement in the market, with the further formation of a downward movement.

Terms of the pattern formation.

1.) The pronounced long-term upward movement in the market.

2.) At the peak of the movement a pronounced upward candle is formed.

3.) The second candle should open above the closing price of the previous one, and its closing price is lower than the closing price of the upward candle.

This pattern is very strong, which is partly due to its rare formation in the market, so try not to miss your chance.

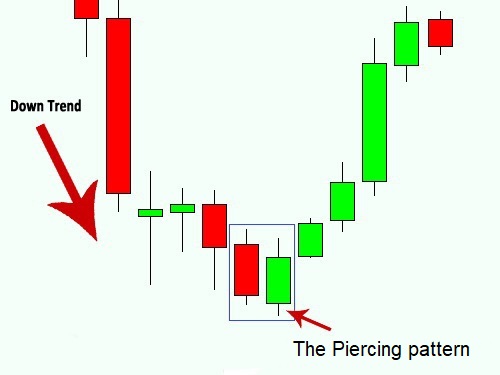

The main candlestick patterns: Piercing pattern

This candlestick pattern is the opposite of the dark cloud cover. The only difference is that the pattern is formed in a pronounced downward movement. After a strong downward candle, an uptrend should form, the opening price of which should be lower than the price of the previous one, and its closing should exceed the closing price of the downward candle.

Note. When trading using candlestick patterns, consider the current market sentiment and do not forget about fundamental analysis. Particular caution should be exercised if the pattern is formed on the eve of the publication of significant economic data in the calendar, which can affect significantly the foreign exchange market.

Alexander Sivtsov