Очікування від липневого засідання ФРС США

Після ряду виступів глави ФРС США Пауелла, який натякнув на можливість зниження ключових процентних ставок в США, на ринку різко зросли очікування зниження ставок, які вже фактично врахували у вартості долара США зниження ключової процентної ставки на 25 б.п., з позначки 2,50% до рівня 2,25%. Незважаючи на те, що липневе зниження ставок уже враховано ринком, є високий ступінь невизначеності щодо подальшої монетарної політики ФРС США.

Очікування ринку

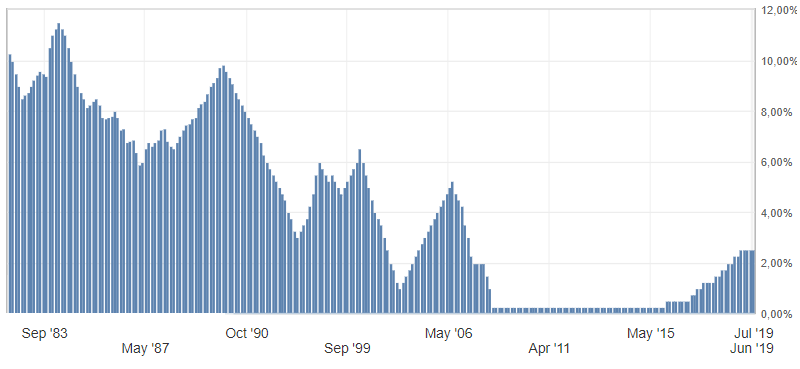

Почнемо з того, що останній раз ФРС знижувала ставки в грудні 2008 року, одинадцять років тому. І цьому рішенню сприяла криза. На даний момент про подібну ситуацію з кризою мова не йде. А основним ризиком уповільнення світової економіки залишається торгова війна США.

Мал. 1. Графік зміни ставок ФРС США

Після дуже м’якої риторики глави ФРС США Пауелла на ринку існує дві основних думки щодо монетарної політики США:

- Зниження ставок на липневому засіданні ФРС США на 25 б. п. і ще на 25 б. п. у вересні або грудні.

- Знизять ставки в США відразу на 50 б. п. на липневому засіданні і не чіпатимуть ставки до кінця року.

Перший варіант виглядає більш правдоподібно, до чого я також більше схильний. До того ж подібний розвиток подій більше відповідає стриманій політиці ФРС США до зниження ставок. Але що важливо, такий розвиток подій зберігає за ФРС місце для маневру. Так, наприклад, в умовах зміни настроїв на ринку і політичної ситуації в США, ФРС може до кінця року переглянути свої погляди на ринок і відмовитися або посилити стимулювання економіки.

Другий варіант виглядає більш жорстким і вигідним адміністрації Трампа. У разі реалізації він значно обвалить долар США по всьому спектру ринку. Подібне стрімке зниження ставок фактично скасує всі питання до ФРС по зміні монетарної політики до кінця року.

Але до такого стрімкого зниження ставок ФРС вдавалася тільки в кризовий період. Крім зниження долара США, це може викликати побоювання ринку щодо більш значного уповільнення економіки США.

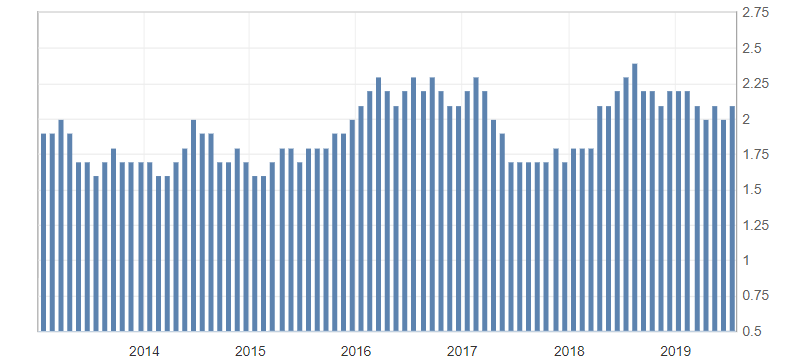

Незважаючи на всю авторитетність джерел, які очікують зниження ставок в США. Вони всі грунтуються виключно на м’якій риториці глави ФРС. Пауелл висловив сумнів щодо зростання споживчої інфляції в США. Останній, в свою чергу, виглядає більш впевнено, ніж в кінці 2017 початку 2018 років.

Мал. 2. Графік базового індекс споживчих цін (ІСЦ) в США (рр)

Антон Ганзенко