Martingale and the application of its strategy on cross-rates. Anton Hanzenko.

Given the very ambiguous glory of martingale in Forex, you can discuss the pros and cons of this strategy for a long time, but you need to know about it. As you know, martingale’s strategy can be very efficient, but also very risky because of its specifics. So, any strong movement can cause significant losses, up to the discharge of the deposit. In turn, the zigzag movement or wide flat becomes very effective for martingale application.

Martingale – application

This trading approach using martingale is suitable for experienced traders who know how to assess the state of the market and think well about money management. An additional risk factor is cross-rates, which are also not recommended for trading by novice traders.

Considering the fact that martingale is well-suited for corridor movements, when the currency pair moves in a strictly defined trading range, and among the cross-rates there are pairs that are prone to corridor movement, there is a logical possibility of combining these conditions.

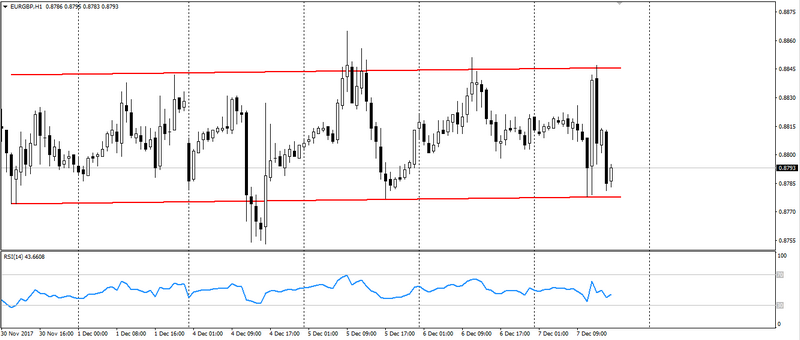

The main essence of martingale’s strategy is to find trade corridors on cross-rates and use martingale on them. These crosses include: EUR/GBP, GBP/JPY, EUR/JPY and some others with high volatility.

Trading restriction on this principle are days with significant news, statements on a particular currency and political risks that can cause the formation of rapid trends, what is the main disadvantage of martingale. Also, this approach is not recommended for low volatile crosses, for example EUR/CHF, due to the low intraday motion amplitude.

One of the striking examples is the cross-rate EUR/GBP, which is characterized by considerable volatility and very stable trends. For additional signal filtering, oscillators, such as RSI or Stochastic, can be used.

In such cases, you can completely focus on martingale, but do not forget the news and do not leave such transactions unattended for a long time. Sooner or later, the trend is changing, and in martingale and cross-rates it can be times more dangerous.

The use of martingale on cross-rates can be efficient and useful only in the conditions of strict performance of management. Then cross-rates and martingale will prove to be an excellent tool for making money.

Anton Hanzenko