Мартингейл и применение его стратегии на кросс-курсах. Антон Ганзенко.

Учитывая весьма неоднозначную славу мартингейла на Forex можно долго обсуждать плюсы и минусы данной стратегии, но знать о ней нужно. Как известно, стратегия мартингейла может быть весьма эффективной, но также и весьма рисковой в силу своей специфики. Так, любое сильное движение может вызвать значительные потери, вплоть до слива депозита. В свою очередь, зигзагообразное движение или широкий флэт становится весьма эффективным для применения мартингейла.

Мартингейл – применение

Данный подход торговли с использованием мартингейла подойдёт опытным трейдерам, которые умеют оценивать состояние рынка и хорошо продумывают манименеджмент. Дополнительным фактором риска выступают кросс-курсы, которые также не рекомендуются для торговли начинающим трейдерам.

Учитывая тот факт, что мартингейл хорошо применим на коридорных движениях, когда валютная пара движется в строго заданном торговом диапазоне, а среди кросс-курсов существуют пары, которые склонны к колидорному движению. Возникает логичная возможность объединения данных условий.

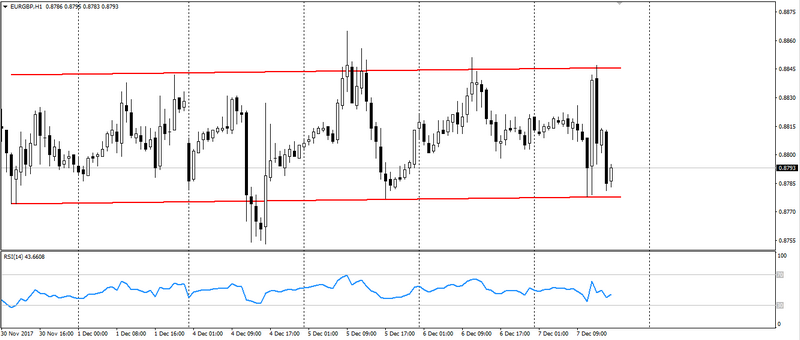

Основная суть стратегии мартингейла заключается в нахождении торговых коридоров на кросс-курсах и использовании на них мартингейла. К таким кроссам можно отнести: EUR/GBP, GBP/JPY, EUR/JPY и некоторые другие с высокой волатильностью.

Ограничением торговли по данному принципу станут дни со значимыми новостями, выступлениями по той или иной валюте и политические риски, которые могут вызвать образование стремительных трендов. Что является основным недостатком мартингейла. Также не рекомендуется использовать данный подход на низко волатильных кроссах, к примеру EUR/CHF, в силу низкой внутридневной амплитуды движения.

Одним из ярких примеров остаётся кросс-курс EUR/GBP, который отличается значительной волатильностью и весьма устойчивыми трендами. Для дополнительной фильтрации сигналов можно использовать осцилляторы, типа RSI или Stochastic.

В таких случаях можно полностью сосредоточиться на мартингейле, но не стоит забывать о новостях и оставлять подобные сделки без присмотра на длительное время. Рано или поздно тренд меняется, а в условиях мартингейла и кросс-курсов это может быть в разы опасней.

Применение мартингейла на кросс-курсах может оказаться эффективным и полезным, только в условиях жёсткого выполнения мани менеджмента. Тогда кросс-курсы и мартингейл окажутся отличным инструментом для заработка.

Антон Ганзенко