Correlation strategy for trading in the Forex market. Anton Hanzenko.

Продовжуючи тематику крос-курсів і торгівлі на них, не можна залишити поза увагою тему кореляційної стратегії для торгівлі на кросах. Раніше вже згадувалося про стратегії, які підходять як для крос-курсів, так і для основних пар, але сьогодні хотілося б поговорити саме про стратегію для кросів. Однією з таких стратегій і є Кореляційна стратегія.

Кореляційна стратегія: основні принципи

В основі Кореляційної стратегії лежить принцип кореляції на ринку Forex. У загальних рисах кореляція на ринку Forex є односпрямованість чи різноспрямованість окремо взятих валютних пар. Фактично кореляція – це зв’язаність руху окремих валютних пар. Кореляція – непостійна величина на ринку і час від часу змінюється. Так, кореляційні пари можуть повністю повторювати динаміку одна одної або рухатися в протилежному напрямі з певною часткою відповідності.

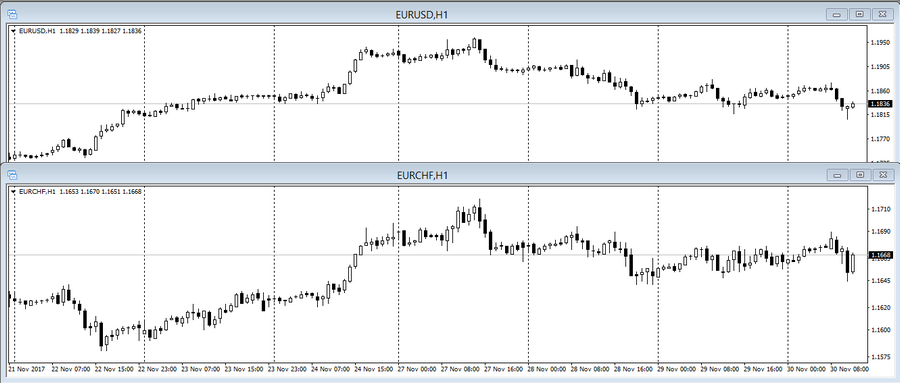

Одним з широко поширених прикладів кореляції є пари EUR/USD та EUR/CHF, які мають пряму кореляцію. Тобто, пари рухаються однонаправленно.

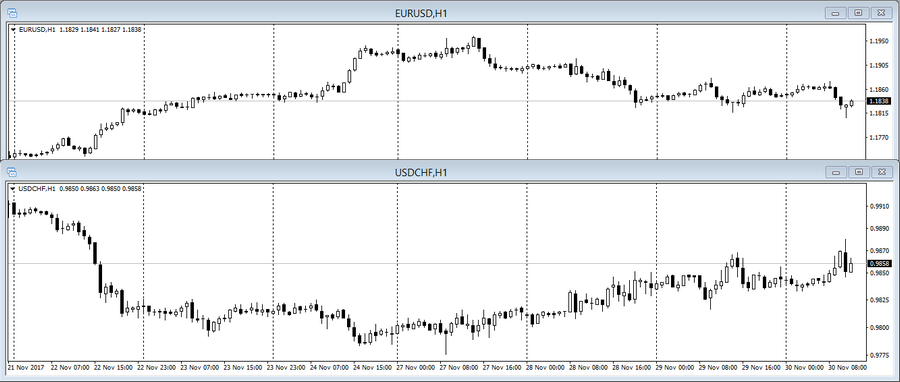

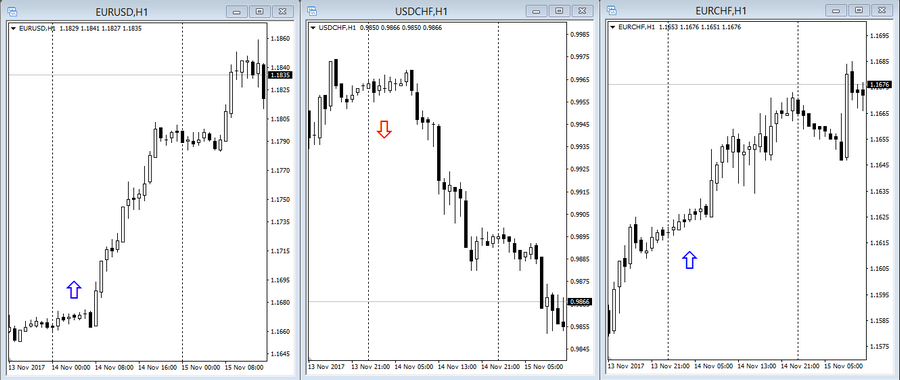

Прикладом зворотної кореляції виступають пари EUR/USD та USD/CHF, тобто пари рухаються різноспрямовано.

Таблицю кореляції валютних пар можна знайти тут. За допомогою таких таблиць ми і будемо визначати, за якими парами стежити і на яких кросах торгувати.

Суть «Кореляційної стратегії» полягає в тому, що б виявити високий рівень кореляції в основних парах і зайти в угоду на крос-курсі.

Так, при зворотній кореляції пар EUR/USD та USD/CHF, чекаємо сигналу на покупку для EUR/USD та сигналу на продаж для USD/CHF, після чого купуємо EUR/CHF. І зі зворотнбьою послідовністю для продажів. При зниженні EUR/USD та зростанні USD/CHF – продаємо EUR/CHF.

З огляду на той факт, що прибутковість одного пункту в кросах вище ніж в мажорів, прибуток з торгівлі буде значним, навіть якщо на кросі незначний рух.

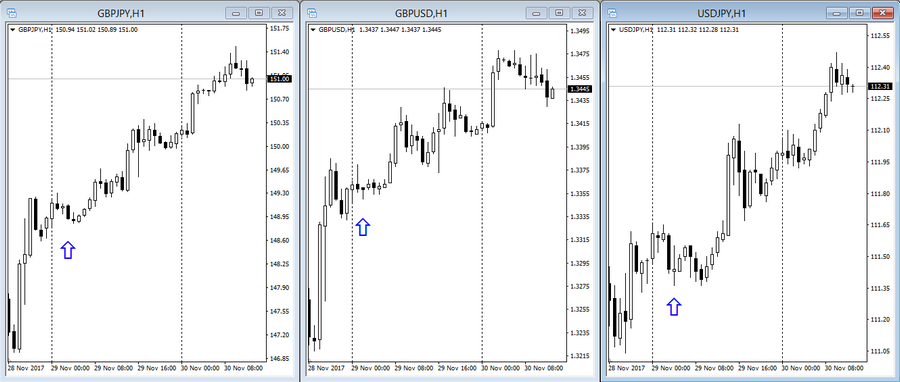

Приклад з прямою кореляцією пари GBP/USD та USD/JPY:

При зростанні пари GBP/USD зміцнюється фунт, а при зростанні пари USD/JPY слабшає єна. Тому доцільно купувати пару GBP/JPY. Зворотна ситуація при зниженні пар GBP/USD та USD/JPY продають GBP/JPY.

Основною умовою «Кореляційної стратегії» для успішної торгівлі буде коефіцієнт кореляції більше 60. Тобто, коефіцієнт кореляції повинен бути «+» або «-» більше 60. Показник нижче 60 вказує на низький рівень кореляції, що говорить про слабкий зв’язок між валютними парами.

Принцип стратегії вельми простий і в той же час дуже значущий, тому «Кореляційна стратегія» буде досить ефективною при правильному застосуванні.

Детальніше про дану стратегію і не тільки можна дізнатися з курсів навчання, які пропонує компанія Ester Holdings Inc.

Ганзенко Антон