Correction is an integral part of the price movement in the market and one of the main assistants to the trader. Alexander Sivtsov.

Movement in the market is often quite changeable, which is facilitated by various fundamental and technical factors. The fundamental factors are one or another event that provokes market participants to buy or sell various foreign exchange instruments. The fundamental factors determine the direction of the trend in relation to a certain currency. But the development of currency instrument movement will be affected particularly by the technical component – Correction.

Correction (pullback)

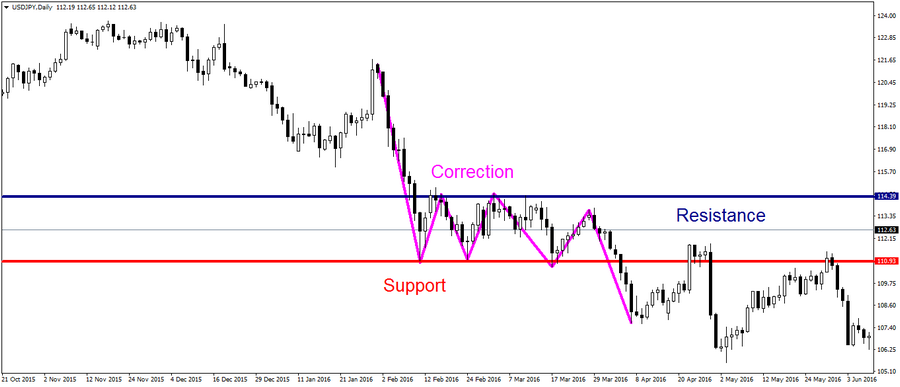

Correction or a pullback is a movement in the market, which is the opposite of the main direction of the trend. Most often, the correction occurs after the next update of the local maximum or minimum. When updating local marks, the main currency of a traded instrument often becomes overbought or oversold.

Oversold and overbought indicate that the formed price for the current moment does not quite correspond to the market reality and requires the so-called Correction. To determine whether the instrument is at overbought or oversold levels, a number of different indicators such as CCI, RSI, Stochastic Oscillator, MACD, etc. help.

In addition, the correction of positions occurs not only with the next update of local highs and lows, but also when the price reaches the previous highs, which are also called significant price levels. To find out more about significant price levels see the article “Price Levels – Technical Analysis Tool.”

Correction based on price levels occurs because a certain price has a strong value for market participants. When a certain price is reached, large number of transactions in the opposite direction is made and this presses on the price. Therefore, the price pulls back.

Why correction is so important?

Understanding the principles of correction helps the trader not only to enter into more profitable positions, but also to make money concluding more deals regardless of the trend direction. One of the simplest and most effective trading strategies based on correction is trading with Fibonacci lines. For more information refer to a previously written article on the theory of the golden section.

Carefully follow the technical analysis and experts opinions from Ester Holdings Inc. Company to be aware of possible price corrections of various trading instruments and successfully make a profit.

Alexander Sivtsov