US DOLLAR INDEX AS AN ADDITIONAL INDICATOR. ANTON HANZENKO.

While trading in the Forex market, everyone faced at least a few indices. Typically, these are DOW indices, NASDAQ or other market-related stocks that reflect the overall dynamics of the basket of some assets.

Today, we will talk about the US dollar index or DXY. The US dollar index is an important financial instrument reflecting the strength of the US currency against a basket of world currencies: the euro, the British pound, the Japanese yen, the Swiss franc, the Swedish krone and the Canadian dollar. This index is calculated as a weighted geometric mean; the value of currencies are not equally taken into account in the index. The influence of major currencies has the following percentage effect on the US dollar index: EUR – 57.6%; GBP – 11.9%; JPY – 13.6%; CAD – 9.1%; CHF – 3.6%; SEK – 4.2%. Therefore, the growth of the US dollar against the euro significantly affects the index than the growth of the American against the Canadian.

The US dollar index (DXY) in currency pairs trading is used mainly to determine the overall dynamics of the US currency and its strength. Therefore, the index is often used as an auxiliary indicator for trading in pairs containing USD. Despite the fact that the index uses only 6 currencies, it can be applied to all pairs with the US dollar.

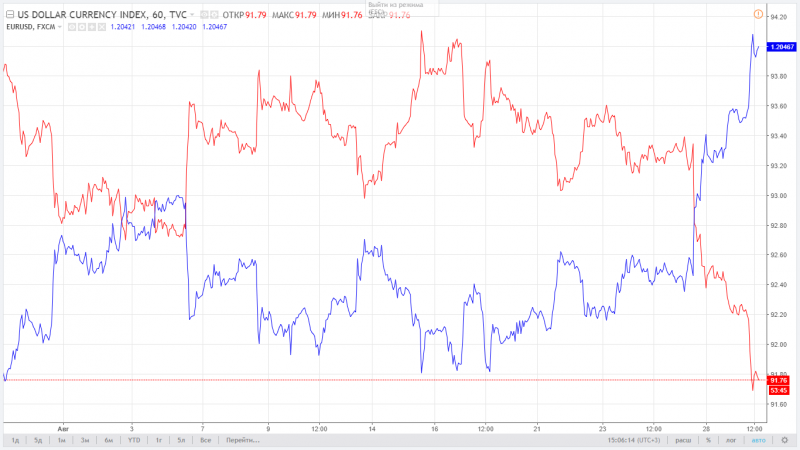

So, the most obvious inverse relationship is traced on the dollar index and the EUR/USD pair.

Red line displays the US dollar index, and blue one – the EUR/USD currency pair. Crossing or changing the direction of the lines will indicate a trend change. In addition, this index is perfectly amenable to technical analysis, which can serve as an excellent auxiliary indicator for determining the further dynamics of the US currency.

The second good example for comparing the dollar index (the red line) is the pair USD/JPY (blue line).

Unlike the first case, there is a direct dependence that allows technical analysis and weed out false movements, relying on the index of the American currency.

An example of the reverse dependence of the dollar index (red line) and the pair AUD / USD (blue line) is given, to confirm that the US dollar index can be used with currency pairs that are not included in the index.

The US dollar index is an effective indicator of the strength and direction of the US currency, which can serve both to assess the very state of the US dollar, and all currency pairs that contain the American dollar. But, like all indices, the US dollar index is an approximate indicator and should be regarded as an auxiliary index.

Read my previous article “STATE BONDS AS A LEADING INDICATOR OF FOREIGN EXCHANGE MARKET”

ANTON HANZENKO