EUR/USD today: the pair is on the verge of correction

On Wednesday closed with the reduction of the pair EUR/USD at 1.1930, minimum of four months. The publication of the US Federal Reserve’s decision was followed by mixed volatility, but the day was closed in minus, which was caused by the continued optimism of the American on the growth of inflation forecasts and the persistence of high employment in the US.

Events for today:

- 12:00 – preliminary data on inflation in the euro area.

- 15:30 – a news block on the US: the number of initial applications for unemployment benefits in the US, the level of productivity in the non-agricultural sector of the United States (q/q), the trade balance of the United States and labor costs in the US (q/q).

- 16:45 – data on business activity in the US.

- 17:00 – data on the US: the volume of shipments of US civilian goods (excluding aircraft), the volume of orders for durable goods in the US (m/m), the volume of industrial orders in the US (m/m), the index of employment in the non-manufacturing sector (ISM) of the United States and the index of business activity in the non-manufacturing sector (PMI) of the United States from ISM.

The day is very busy with statistics on the United States. At the same time, the market will also begin to prepare for tomorrow’s report on employment in the US.

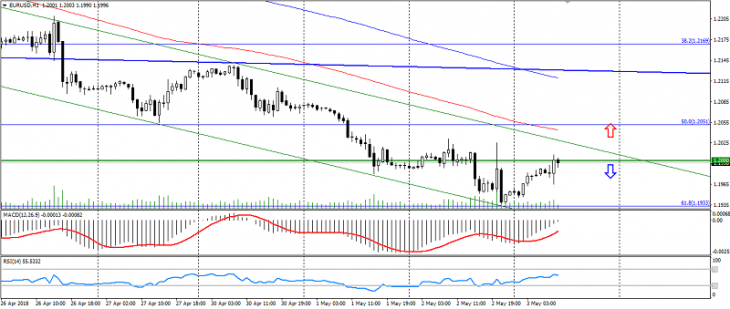

The EUR/USD has noticeably adjusted since the beginning of the day on the weakness of the American. The negative opening of the stock exchanges in Europe contributes to the correction for this pair. The level of significant resistance is 1.2000-20. Fixing the pair above will indicate a deeper correction to the resistance levels: 1.2050 and 1.2080. Support is located at the levels: 1.1970 and 1.1940-30, the return to which will indicate the preservation of a downtrend.

Fig. EUR/USD. Current price – 1.2000

Hanzenko Anton