Gold. Expectations for March 2019!

Expectations for gold in February “Gold. Expectations for February and March 2019” fully justified themselves, showing a very rapid development in a few weeks.

Despite the significant bearish signal on the D1 timeframe, gold worked out a bullish “inverted head and shoulders” signal, which eventually received an extension in the form of a “double bottom”.

“Gold began to form an“ inverted head and shoulders” pattern, which, after completion of the formation, will indicate a resumption of growth, but, in turn, will be limited to existing extremes and a number of geopolitical factors”

An additional significant factor that accelerated the processing of bullish expectations for gold was geopolitics. Gold was supported by the persisting difficult situation around the US-China trade talks, despite the fact that many parties involved in the negotiations argue about very productive negotiations, inspiring growth in stock markets and commodity markets. Many investors prefer to reduce partially the risks by resorting to the classic safe haven assets – gold.

Separately, it is worth noting the growth of gold in the slowdown of the global economy, which also plays a very significant role. Since the growth of gold may indicate the possibility of a crisis.

Expectations for gold at the end of February – the beginning of March

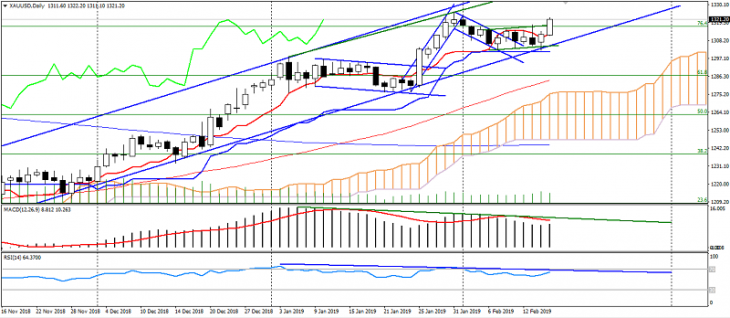

We return to the divergence on the daily timeframe, which is preserved and strengthened by a significant overbought of gold. It is traced in the figure below.

Expectations for the decline in gold are preserved, while they were complemented by the expectation of a correction against six-month growth. The signal for the correction will be the formation of a reversal, the formation of which is expected to range from 1320.00 to 13330.00.

The risk factor in this situation is the failure in the US – China trade talks, which will provoke further strengthening of gold to exacerbate fears of a slowdown in the global economy, effectively breaking the signal of a bearish divergence and opening the way for buyers to resistance to 1350.00.

On the reduction of geopolitical risks and the very optimistic results of trade negotiations, we should expect the formation of a reversal and the refraction of the upward trend in gold. Significant support levels are located at levels: 1302-00.00 and 1290.00.

Anton Hanzenko