Japanese dawn or what to expect from USD/JPY at a meeting of the Bank of Japan

The week begins and the life of the trader continues. Let’s start another hot week of exchange trade. I believe that it will fill not only my and your pockets with money, but also replenish our libraries of colorful trading moments. With you a connoisseur of high materials and large incomes – Andrew Green.

What can be more delicious for our carnivorous perception of trade than another opportunity to see the increased volatility of the market during a press conference and meetings of national banks? The answer is NOTHING !!! This is a dessert. These 100-point candles, like candles on a cake at the birthday party. And I think that we will have such an opportunity to enjoy this holiday this week.

What do we expect from the Bank of Japan this week:

- it will continue to reduce the volume of purchases of government debt, thereby confirming further plans to return to normal monetary regimes;

- it will announce plans to further raise the rate on state funds by 10 bp., with benchmarks for the second half of the year.

We can say that there are very positive expectations, but it should be noted that the strengthening of the Japanese currency to levels below 110.00 continues to be under the special control of the Bank of Japan and fraught with its indirect intervention. Therefore, in my opinion, the corridor, which was formed throughout the past year in the range 108.00-115.00, will remain valid for a while.

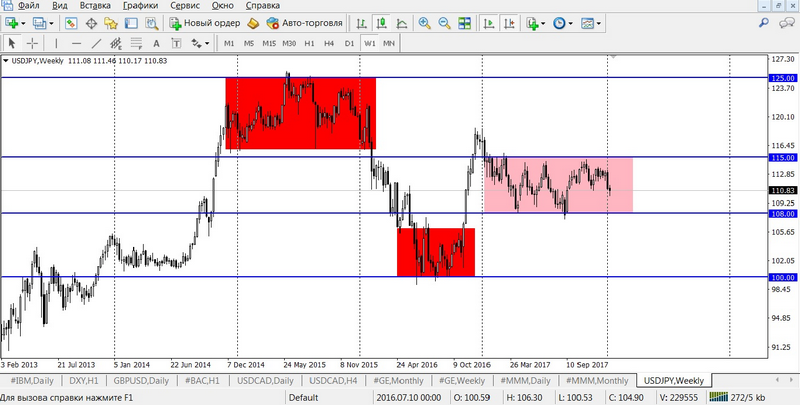

Look at Figure 1. There, as you can see, is clearly traced the natural tendency of the Japanese yen to tunnel passages and trade in the ranges.

My trading recommendation: adhere to resistance and support lines of the existing range.

Trade recommendation: SELL from resistance line and BUY from the support line.

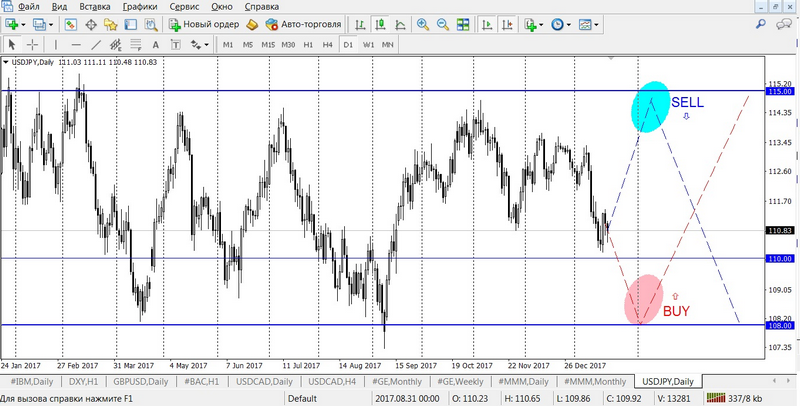

In more detail, you can consider the situation on the daily timeframe (Figure 2).

The pink zone is the most acceptable range for purchases.

Examples of transactions:

- conservative option:

BUY limit 108.30, SL 107.80, TP 108.90 - aggressive option:

BUY limit 109.30, SL 107.80, TP 110.80

BUY limit 108.30, SL 107.80, TP 108.90

In the case of developments in the other direction, we work using the following option: from the resistance line (blue zone) – we sell.

Examples of transactions:

- conservative option:

SELL limit 114.70, SL 115.30, TP 113.90 - aggressive option:

SELL limit 113.90, SL 115.30, TP 112.40

SELL limit 114.70, SL 115.30, TP 113.90

The secret of trading in the channels and in the absence of a bright and pronounced trend is in the full individual course, in any of the programs that you can find on the Ester website.

Success in the market is not in the ability to determine the trend on the chart, but in the ability to form this trend on the balance of your account.

Success in trade – the lot of persistence, confidence and a clear attitude to the result!

Andrew Green