Fundamental analysis: The impact of GDP indicators on world currencies. 1/2

After clarifying employment and inflation as aspects of fundamental analysis, one can not pass by such an important indicator of the economy as GDP and its impact on world currencies.

Basic concepts

GDP or Gross Domestic Product from the course of the economy is considered to be one of the most important economic indicators, which indicates the total quantity of goods and services produced for a certain time.

Indicators of GDP dynamics have a close direct relationship with long-term investments in the currency, as the sustained growth of the Gross Domestic Product provides continued support to the national currency. There is also a backward link with the slowdown in GDP growth or its decline in the long term. The currency will be put under pressure.

Therefore, the publication of GDP indicators in the foreign exchange market Forex is regarded by the market as a very significant factor for the movement of a currency. The publication of GDP data, like the above-mentioned data on employment and inflation, is suitable for trading on news.

Leading GDP Indicators

Leading indicators are the economic indicators that characterize the national economy’s conjuncture, thus giving an idea of the change in key indicators.

Leading indicators of GDP in different countries is the index of business activity (PMI) in different sectors of the economy, the main of which is production, construction and services.

Also, these indicators include: indicators of economic sentiment in different sectors, the indicator of economic expectations, the index of consumer confidence and others. These indicators are very diverse and vary from country to country. At the same time, many of them have practically no influence on the market due to their low importance. At the same time, it is necessary to know about these indicators at least in order to respond in time to changes in the indicators of Gross Domestic Product.

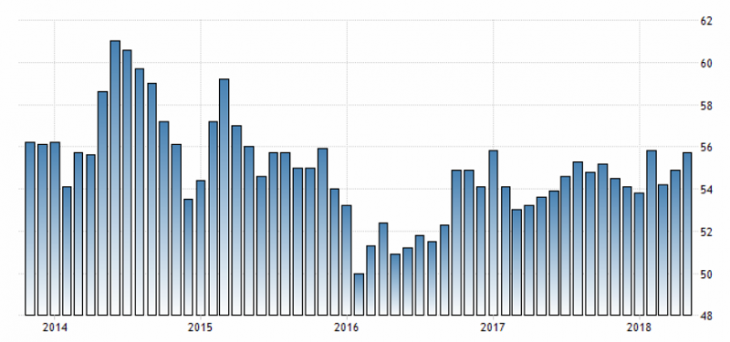

An example of the effect of the US Composite Index of Business Activity (PMI) and US GDP growth:

Fig. 1. Composite index of business activity (PMI) in the USA

Fig. 2. US GDP growth rates

As can be seen from the example, there is a direct dependence: with the growth of PMI – GDP is also growing. But it is worth noting that this pattern can be traced only on large timeframes. And the index of business activity is a leading indicator, so GDP data play a big role, because they are final.

In the next part of the article, we will consider examples of analysis of GDP indicators and their impact on the market and directly on the currency itself.

Anton Hanzenko

You can find many other topics on the site in the Trader’s Blog!

And if you have an offer – what to write about in the next article – write to us at info@esterholdings.com!