Trading on news! Let’s consider in detail. Anton Ganzenko

Trading on news is a very common method of trading on the Forex market and not only. This approach applies to the stock and commodity markets, taking into account the specifics of the market and the news applied to it.

At the same time, this trading approach is suitable for people who, because of busyness or lack of free time, couldn’t spend a lot of time behind the screen in search of signals for market entry. Trading on the news is a unique strategy that allows you to earn a lot of money in seconds.

Trading on news by nature is similar to scalping or other short-term strategies. So, in the trading on the news very impressive size of the deposit with small goals and stops are used, which should be calculated individually, taking into account money- management and specific conditions of the trading instrument (volatility, the importance of news). There are news that may have a long-term influence on the market or currency, but mostly it is an exception. And the approach to trading on news involves entering transaction on news when the impulse created by the news has great power. But it is necessary to go out immediately when this impulse begins to fade, before the formation of correction.

News that affect the Forex market:

Often, this strategy uses news with high volatility, that is, those that can have the greatest impact on the currency or the market. It uses only planned news, that are in the Economic Calendar. Unexpected news (scandals, unforeseen statements, wars, natural disasters or force majeure) are not used due to unpredictability.

The US is particularly popular in trading on the news because of the importance of the US currency and its popularity. News from other countries can also affect the currency on which they issue. At the same time, the same data can be called differently in different countries and have a different effect on currencies.

For example, data on interest rates in the US and Switzerland are perceived very differently, largely due to market expectations. Expectations of the market to a greater extent and determine the volatility of the market. So, the decision on interest rates in the US and any news on them are perceived very booming by the market because the FED adheres to the tightening of monetary policy. On the other hand, the Swiss National Bank keeps the unchanged interest rate from the start of 2015, so it maintains low volatility on this news.

Accordingly, if market expectations differ significantly from the actual value, this news may have a strong impact on the market. Even if it had not exerted a strong influence or was considered by the market as low-volatile.

At the same time you can highlight the main news, changes affecting all currencies. But looking at how much they change.

High- volatile news:

- GDP, GDP changes, GDP growth rates, GDP forecasts, etc .;

- employment, unemployment rate, number of jobs created, etc .;

- inflation, CPI, wage growth, cost growth, etc .;

- interest rates, interest rate forecasts, etc .;

- meetings of the Central Banks, their protocols and the statement of their representatives and politicians. This item may include many other branches of the economy. At the same time, the speech of a political or economic figure can be either unambiguous, or not unambiguous.

Less volatile news:

- Indices of business activity in industry, services, etc .;

- data on real estate, number of construction permits, construction of new houses, sale of houses, etc .;

- volumes of production and sales in various branches of the economy.

This list can be continued for a very long time. But, one way or another, the impact of news on the market will depend on the difference between the expectations / previous values and the actual value, and the difference is greater, the volatility of the currency will be greater.

Ambiguous news

In addition, there is such a concept as the ambiguity of the news. For example: the number of jobs has grown, and the employment of the population has decreased. In this case, it’s worth looking at the full news block and perceiving it as one news, analyzing the significance of changing all the parameters.

Ambiguity can also be speeches or reports. For example: an official’s statement begins with a hawk tone, which talks about positive growth rates of the economy, but he finishes his speech with expectations of weak inflation. As a result, swings are formed on the market. As a result, this presentation should be measured as one news and for a specific example, a negative as this one.

After figured out a little with the news, let’s talk about the direct tactics of trading on the news.

Trade principles

As it was said above, trading on the news is similar to scalping or other short-term strategies. Therefore, trading on the news will have similarities with short-term strategies.

Therefore, trading on the news will have similarities with short-term strategies.

Trading in the news, you can use fundamentally different approaches to trading: enter directly on news or use pending orders. Each of the approaches also has its pros and cons.

Thus, the instant execution of the order may not be deliberate and incorrect and rely exclusively on the crowd opinion. On the other hand, the delayed order often loses a significant part of the impulse, which reduces the effectiveness of the strategy.

We can discuss long time the effectiveness of this or that approach in trade. Putting down these nuances, one can say that each one is determined on the basis of his own approach to trade.

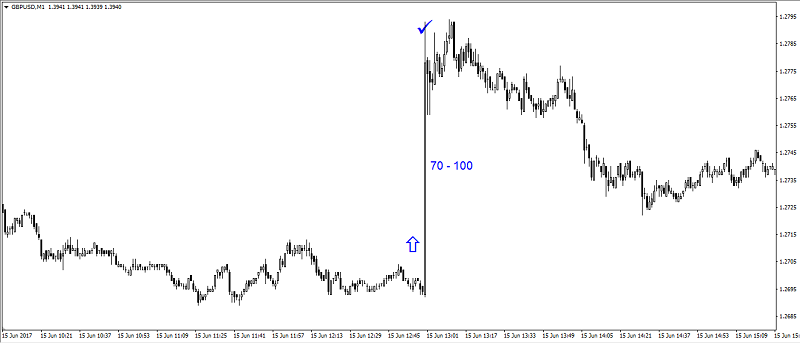

An example of the effectiveness of the trading approach on the news may be the publication of the results of the Bank of England meeting for June, which turned out to be very optimistic, and could bring from 70 to 100 points of profit.

At the same time, it was possible to use both the entrance on pending orders and the instant execution.

While trading on news, it’s worth to remember a few important rules:

- What is expected from the news and how it can influence. For this it is worth to look the previous values or forecasts, if it is statistical data. If it’s a performance or a report – pay attention to analytics or market expectations. What you can see in the Economic Calendar.

Also, information about meaningful speeches or events can be found in the Expert Opinion, where expectations and forecasts are given on any significant events.

- In a short time before the news, in 10-20 minutes, look the technical analysis of the pair you are going to trade with. Such analysis, you can find on site in the section Technical Analysis.

Pay attention to trends, levels of resistance / support, psychological levels. They will help not only correctly enter the transaction, but also help to get out of it with maximum profit.

Pay attention to preparing the market for news, correction or acceleration of the trend. If it is any, it will tell you what the market is expecting.

- Carefully analyze the information provided by looking at the forecast in advance and previous values. This will prevent spontaneous actions.

- Realize the risks and goals without forgetting the stop orders.

- If the expectations are not justified in the first seconds or minutes – close the positions.

The approach to trading on the news may seem very simple and very difficult, but it is acting in line with the strategy.

Here is what the experienced trader says about trading on the news:

“If you want to make a decent living, find a way that really helps you. For me, trading is a guarantee of my success and success of my family. Never doubt your strength. After all, each of us can succeed in everything, unless of course to do a little effort for this. Sometimes we are capable of more than we think about ourselves. And if you really want to become a successful trader, you probably understand that there are no short paths. And in order to earn a stable income in the financial market, profound knowledge of fundamental and technical analyzes is required. But what if you do not have a free time to master the principles of trade, and want to make money right now? Then my advice to you: “Trust the trading system” NewsInsider “. With such a trade, the transaction lasts 45 seconds and during this time the trader earns as much as a trader at a manual trade per day or even a week. I believe that people are beginning to become successful when they decide to become such !!! NewsInsider is the key to your success in trading! “

Svetlana Usenko

Summarizing, we can say that Trading on news is an effective working strategy with plenty of advantages, the main of which is the minimal cost of personal time, with high profitability. Of course, for significant efficiency, attention will be needed and strict compliance with the rules of this strategy, which adhere to and keep up to date news will help the site esterholdings.com.

Anton Hanzenko