To increase or not to increase, the difficult choice of the US Federal Reserve

After the US Federal Reserve changed sharply its attitude to monetary policy from aggressive, with a steady rates hikes, to a restrained position, with unchanged rates, the US dollar position was weakened significantly on the world currency arena. So earlier in 2017 and 2018, the US dollar was regarded as a very promising currency due to a steady rates hikes. The position of the Fed toward the rates was clear and aggressive, aimed at raising.

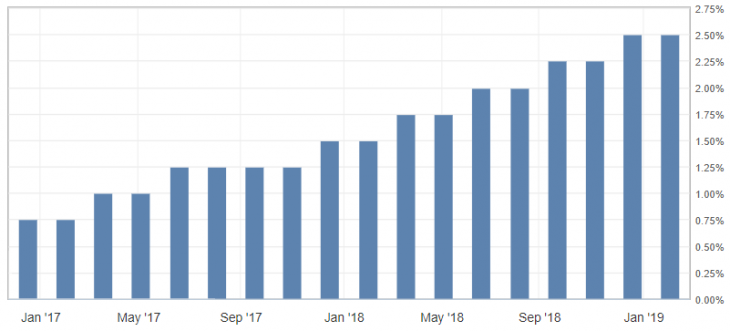

While the major world banks allowed only a few increases a year or only optimistic statements. But at the same time, they kept the actual rates unchanged, resorting only to partial verbal support in the form of raising forecasts or reducing the incentive program. The US Federal Reserve at this time increased rates three times in 2017 and four times in 2018. In fact, over two years, it increased interest rates in the United States from 0.75% to 2.50%

The US Federal Reserve rates hikes chart

For example, the Bank of England for this period raised rates twice.

It is also worth noting that the Fed predicted to continue to raise rates in 2019. And the market expected from two, according to the most pessimistic forecasts, up to four rate increases.

The reasons for the slowdown in the US rate hike

The main reason for the slowdown in the US rate hike was Trump’s policy, and secondly, geopolitical risks and a slowdown in the global economy. The attacks of the Trump administration and the President of the United States towards the Fed and directly the Fed Chairman Powell have been traced since 2018. It was considered unacceptable for most politicians and sharply condemned.

But over time, the entire Fed government succumbed to pressure and changed its aggressive policy of raising rates to a moderately soft one. So the US Federal Reserve from a forecast for a rate increase switched to maintaining the current rate with the possibility of lowering it.

Current position of the US Federal Reserve

The latest FOMC protocol revealed the weird policy of the US Central Bank. Which will be limited to the current rate and retaining the possibility for a one rates increase this year. Justifying this position with the possibility of unexpected economic growth or inflation in the United States.

Market expectations regarding the fate of rates for February 2019 were as follows:

- For maintaining rates at 2.25-2.50 about 92%

- For rates increase to the level of 2.50-2.75 about 2%

- For rates decrease to the level of 2.00-2.25 about 5%

This distribution indicates that the Fed is more likely to lower rates than raise them. The highest probability of lowering the rates falls on the July Fed meeting.

At this stage, the Fed is more inclined to lower rates, which is expected in July. But until that time, a lot of things can change in the US economy, including the rate of growth with inflation.

Anton Hanzenko