The US dollar received support

The US dollar keeps onslaught against the basket of currencies based on the positive data on orders for durable goods in the USA.

- Basic orders for durable goods in September increased by 0.7%, exceeding the forecast of analysts at 0.5%.

- The volume of orders for durable goods rose in September by 2.2%, exceeding the previous value of 2.0%, while analysts expected growth at 1.0%.

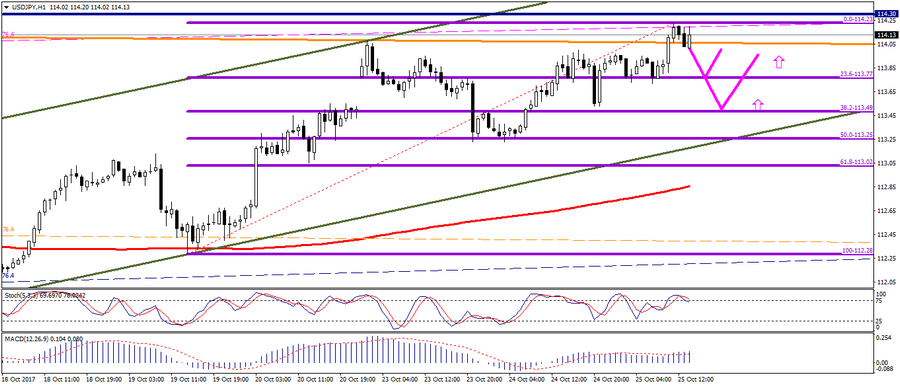

Technical analysis: Based on this statistics for the US, the pair USD/JPY continues to trade near a strong resistance level, one should expect a downward correction in the pair.

Computer analysis: In charts H1 and H4, the Stochastic Oscillator movings indicate overbought of the instrument. Also, on the H4 chart, the “bearish divergence” is formed on the MACD indicator. One should expect a downward correction of the instrument.

Key recommendations: The main recommendation is the purchase of the pair USD/JPY from the basic correction levels of Fibonacci lines 23.6 and 38.2, which correspond to the prices of 113.77 and 113.49, respectively.

In addition, about trading strategy by Fibonacci levels, see https://esterholdings.com/en/2017/04/06/zolotoe-sechenie/

Fig. Current price USD/JPY – 114.13

Alexander Sivtsov