Crazy melodies of the Canadian dollar (USD/CAD), or where my “Prozac”. We trade on and after the decision of the Bank of Canada.

Hello everyone from the forge of the world capital – the international currency market. With you the fighter with poverty for prosperity – Andrew Green.

Yesterday, in the first half of the US trading session, we witnessed another “cardiological” momentum for the pair USD/CAD. And I again assert that the nicknames of the basic quotations, still very aptly invented. And especially in the case of the Canadian currency – the nickname – loony.

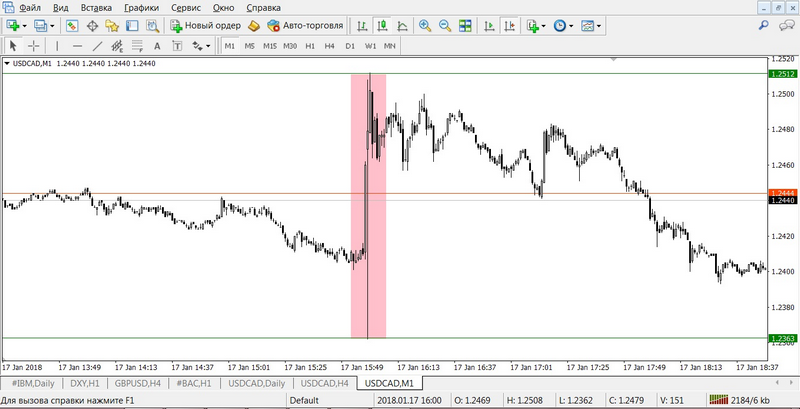

In Figure 1, through the prism of the minute timeframe, one can see that in just 3 minutes the price of the pair made several back-and-forth movements in the range of 160 basis points (1600 pips), from 1.2363 to 1.2512. Even without delving into the essence of what was published in the Bank of Canada’s statement, we understand that there was something very important and ambiguous about it. )

And here is not so much crazy as the USD/CAD itself, as the fact that it makes others crazy, those who trade on it at such events. In the case of these news, the people who traded on the standard breakdown on this pair unequivocally were in panic, almost pulling back immediately after the logical impulse to increase (logical, as the Bank of Canada still raised the discount rate by 0.25 basis points).

Having carefully studied the document, we understand that the positive attitude for fans of the Canadian was spoiled by comments about the negative consequences from the possible US withdrawal from the NAFTA (more details can be found in the article from 11/01/18). And also pay attention to the fact that the Bank of Canada, like some other national banks, shifts the benchmark in analyzing the dynamics of inflationary risks, on the level of wages.

There is much more interesting, but let’s concentrate more on trade.

The main trading recommendation: a short BUY.

If we take a closer look at Figure 2, we see that the balance of forces on the daily chart for the period from 11/01/2018 has not changed much, and the resistance zones are 1.2670-1.2900, and the support zone is 1.2360-1, 2580 remained in force. In turn, a deeper analysis on the timeframe of H4 opens for us the easily visible silhouette of the reversal figure of technical analysis – the “double bottom“.

The entire spectrum of reversal figures and continuation of movement in the modern technical analysis you can get by acquiring and studying at one of our individual training courses about harsh realities of exchange trade.

[maxbutton id = “4” url = “https://esterholdings.com/en/learning/paid-training/modul-basic/#modal-1” text = “Sign up for a course!” ]

In the case of development of this figure, there is a potential for further growth in the pair – to the level of 1.2800. Based on this, we are considering options for further trade.

Examples of transactions:

- conservative option:

BUY limit 1.2380, SL 1.2340, TP 1.2460

BUY stop 1.2610, SL 1.2570, TP 1.2680 - aggressive option (with averaging):

The entry with a BUY double volume from the current 1.2423, SL 1.2340,

TP 1.2560 (½ volume) TP 1.2660 (½ volume)

+

BUY limit 1.2380, SL 1.2340, TP 1.2560

I’m not greedy or gambling, but there is time to throw stones, and there is time to use the opportunities)

Andrew Green