USA VS China – which means a delay in trade opposition

According to the results of the G20 summit, which took place in early December, the United States and China agreed to reduce temporarily the in the trade confrontation tension. The delay in the trade opposition will last until the end of the first quarter of 2019 or until April 2019. Under this agreement, the United States reserves duty at a rate of 10% for Chinese goods, but retains the possibility of introducing 25% duty if it would no agreement on the expiration of this period. China, for its part, pledged to increase imports of agricultural and industrial goods and energy from the United States. Also, there were promises in the approval of the merger of the American company Qualcomm and the Danish NXP.

This agreement provided largely moral support to the market in reducing tension in the US-China trade confrontation, which ultimately resulted in the growth of global stock indices and the sale of the dollar across the market and against the Chinese yuan first of all.

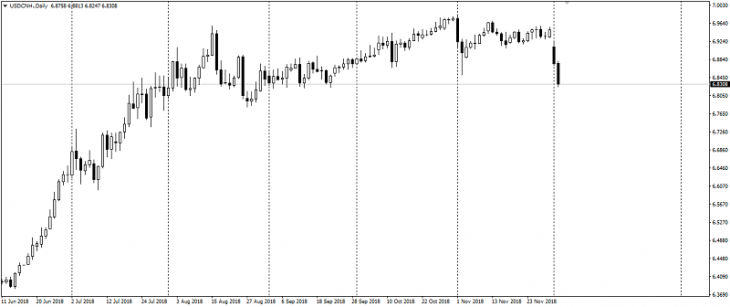

Fig. 1. USD/CNH D1 chart

According to the results of this deal, the Chinese yuan returned to the lows of September of the current year and continues to maintain the potential for recovery during the transition to the correction phase and the growth in demand for risky assets.

The US dollar index was also no exception and weakened against a basket of major competitors, triggering a significant correction against growth and calling into question keeping the upward trend in the US currency.

Fig. 2. The US dollar index chart

The real purpose of this temporary agreement was the regrouping of forces in the trade confrontation, which was actually deadlocked. And the trade opposition of the USA and China itself began to provide more problems than good. At the same time, neither the United States nor China is going to make obvious concessions. These promises at the summit have not yet been confirmed by actual actions, not to mention the completeness of implementation.

The easing of tension in the trade standoff has a positive effect on the global economy, reducing risks. Given the experience of previous negotiations between the US and China and the fact that the US is not going to give up duties on Chinese goods, the new tariffs of 25% are very likely to be introduced against Chinese goods in April.

This period of easing tension can also serve as a kind of transitional period, which, under conditions of partial fulfillment of the conditions or full, will affect the size of the US duty. In the end, they may change from 25% to 20% or 15%, which is more likely under current conditions.

Anton Hanzenko