Equidistant Channel – Trading Strategy. Anton Ganzenko.

An equidistant channel is the basis for one of the most common trading strategies, because it is simple, effective and, what is important, safe. That is why it is widely used by market participants and it is commonly found in complex trading strategies.

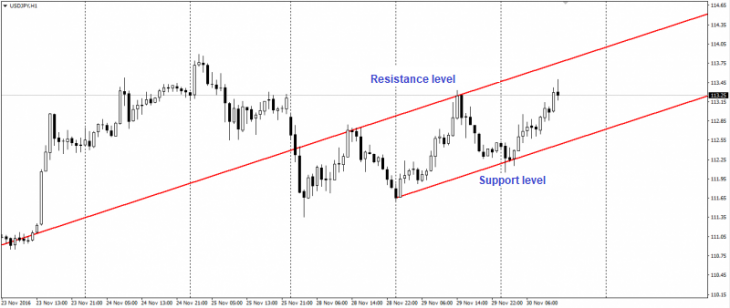

A trading channel is a trading range in which the price moves for a certain time. The boundaries of this channel or corridor represent the levels of support and resistance with which the price counts. The boundaries of the channel must be parallel, because the channel is equidistant. In the FOREX market, there are three types of channels, as well as trends: upward, downward and lateral (flat).

Equidistant Channel – Formation

To build an equidistant channel, at least three extremes, two minima and one maximum or two maximums and one minimum are necessary. You can use four extrema in two minimums and maximums. It all depends on the situation.

To build an upward trading channel, you need two local minima and at least one maximum. It is better when the highs, as well as the lows, at least two, but there are cases when the second maximum has not yet formed.

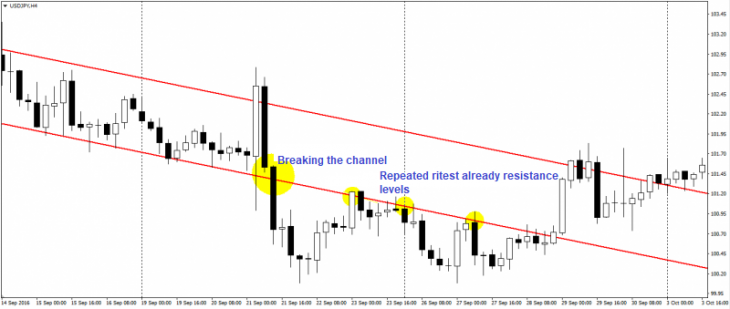

For a downward trading channel, you will need two local maxima and at least one minimum. Just as with the Upward Trade Channel, it is better when there are two highs and lows.

A lateral trade channel or flat is formed when there is no clearly defined trend in the market and the price moves in a side corridor.

The essence of trading within the equidistant channel is to buy from support levels and sell from resistance. In the case of a channel breaking into one of the sides, the level of support changes to resistance, and resistance to support. In this case, on the retest of broken channel we consider new levels as a signal to enter a deal.

An example is when the boundaries of a broken channel change assignments from support to resistance:

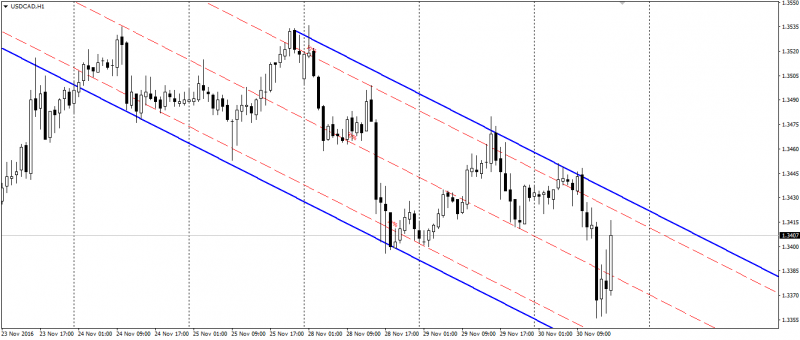

There is also a sophisticated model of trading in an equidistant channel using an additional lines. These lines are calculated by the size of the channel and have the parameters: 50% and 10%. Line 50% – the central line, which is located in the middle of the channel and can serve as support and resistance. Two lines of 10% – are located in 10% of the channel borders. The lines of 10% and the boundaries of the channel form the zone in which they enter the transaction and take profits.

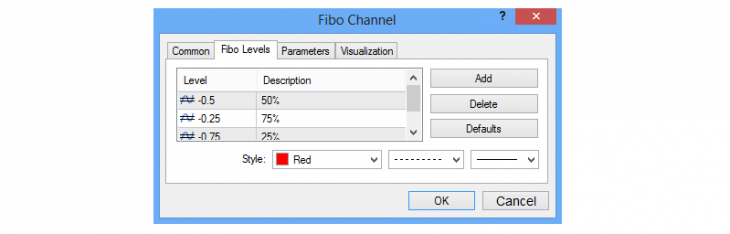

For more convenient use of these levels, you can upgrade the Fibonacci channel tool.

To do this, click Insert -> Channels -> Fibonacci. Set the indicator on the price chart. In the properties of this indicator on the Fiboi Levels tab, we delete the fields and add three new ones with the following parameters:

- Level -0.5; Description 50%.

- Level -0.1; Description 10%.

- Level -0.9; Description 10%.

After that, click “OK” and get the indicator for convenient trading on an equidistant channel.

Despite the fact that channel trading is very efficient, trading on the FOREX market remains difficult. Therefore, you should not regard this indicator as a panacea, which works unfailingly. Alas, as false breakthroughs so and unpredictable price reversals can happen. Despite this, this tool is very effective and can be a great addition to many trading strategies.

Read the Trader’s Blog! Learn new things!

Anton Hanzenko