Iridescent prospects of “eternal” values. Weekly review of GOLD (XAU / USD).

Good afternoon, my dear, priceless participants in the financial market. With you again Andrew Green – a miner of the boundless bowels of the financial market.

Today we will analyze in detail what happens to the main indicator of investor sentiment, as well as the overall dynamics of the commodity market. To your attention – a legendary instrument which history comes from the very origins of human civilization and commodity exchange, a tool for which there is always a place in the investment portfolio of any investor, both conservative and aggressive, I represent today – GOLD.

After this, a little pathos, the introduction of a little general analysis and characteristics of the financial instrument.

Gold is a very special commodity on the commodity market and a very special asset in the financial instruments market. As a commodity, it has all the relevant characteristics, rises in price on the overall growth of the world economy and international demand for a commodity group (oil, ore, metals). In turn, being a security tool, is in great demand during the period of sharp increase in panic sentiments in related markets (currency, stock, state obligations market). The only reason for cheapening is the own dynamics of USD.

For today, there are plenty of reasons for the growth of Gold:

- a weak dollar, due to a slowdown in the general growth dynamics and uncertainty of the nearest actions on the part of the Fed;

- panic in the stock markets around the world, due to the rally of the past few weeks;

- general dynamics of the commodity market;

- sale in the US government bonds market.

In turn, there are also factors that reduce the demand for precious metal:

- stabilization of monetary policy in the European region, Japan and China;

- decrease in the temperature of geopolitical confrontations in Europe and the Middle East.

In general, there is a certain advantage in the direction of further strengthening of the position of Gold in the financial market. But let’s now study more closely the technical component of financial instrument analysis.

Let’s start, perhaps, with the Figure 1, timeframe: a week.

As you can see, we have a clear growing trend, which began to form at the end of 2015, but was periodically restrained by the zone of resistance around 1360-1370 USD. This zone has shown itself very well for 4.5 years, repeatedly restraining the growing impulses of the pair. It is hard to say if it sustains this time. All the same, the dynamic of constantly rising minima also looks very strong. But, in any case, we adhere to the rule that before the breakdown of the resistance line, first of all, we consider the probability of a reversal from it. Therefore – we will sell)!

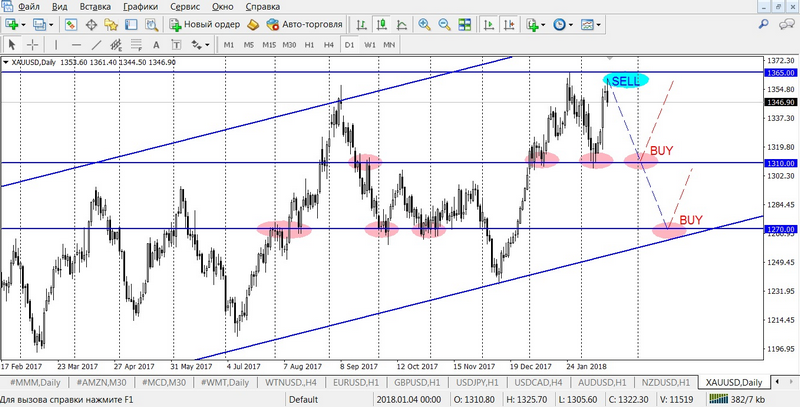

We go further to Figure 2 and the day period.

As we can see, an analysis of horizontal levels shows itself very well here. In order to more deeply study this section of technical analysis, I propose and recommend that you take an individual training course from our partner Ester, you can get more information on the site, and fill out an application for training.

On the daily timeframe, we clearly see, already mentioned earlier, the resistance level at 1365 and support levels at 1310 and 1270 USD. The last level of support is also strengthened by the support line of the growing weekly channel. This zone is just super attractive for purchases, but the likelihood of such correction in the near future – is minimal.

As for the 1310, it is very promising to enter the purchase, and hold until the rite again 1365.

For intraday and weekly trading, for this instrument it is best to go further to the timeframe H1 (hour).

It is worth considering the support zone at 1335-1340 USD. As we can see, over the past two weeks this range has acted as a support line, as well as a resistance line. This time, it is strengthened by a line of support for the growing trend of the last 10 days. So the main recommendation is the purchase, but consider all the options.

Examples of transactions:

- SELL limit 1365, SL 1380, TP 1340

- BUY limit 1335, SL 1320, TP 1365

- BUY limit 1310, SL 1295, TP 1345

When trading on Gold, you must take into account the high cost of the item and the lot. If you need advice for the correct choice of the volume of the transaction, write to support@esterholdings.com with a note “for Andrew Green”.

And I love Gold! It is this financial instrument that gives a feeling,

that you breathe the air of possibilities. Breathe deeper, gentlemen traders.

Andrew Green