Interest rate of the Bank of England

As expected, the Bank of England raised its interest rate from 0.25% to 0.50%, thereby causing a sharp rise in price of the British currency against the US dollar by about 50 points. But, after a minute, the GBP/USD pair turned sharply to the north.

The main pressure on the pound was made by some forecasts of the Bank of England.

- According to the forecast of the Bank of England, the key interest rate will double again by 2020 and will be 1.0%.

Inflation will approach the level of 2.0% by 2020. - The Bank of England lowered the forecast for GDP growth for 2018 from 1.8% to 1.7% and predicts that this growth will continue until 2020.

- The Bank of England notes that Brexit is strengthening the economic slowdown.

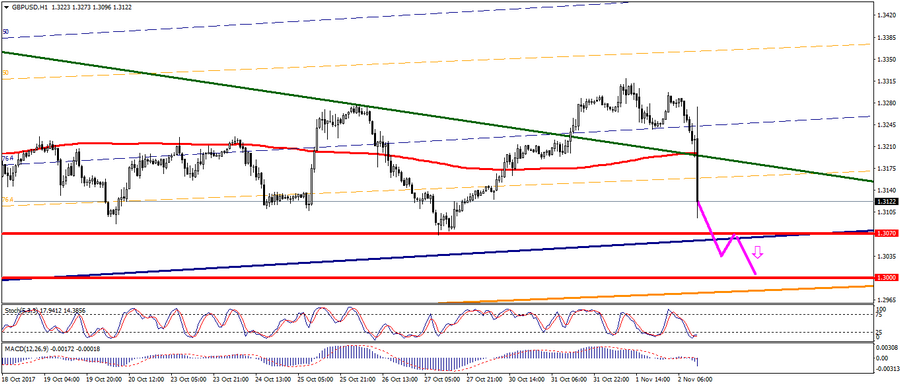

Technical analysis: Based on the meeting results, the GBP/USD pair returned to the downtrend channel on H1 that signals about the continuation of the downward movement of the pair in the short term. The nearest support level is considered at 1.3070. If the price is fixed below this level, the pair will open the way to the level of 1.3000.

Fig. GBP/USD current price is 1.13122.

Alexander Sivtsov