In Focus: a profitable deal in May! Let’s analyze?!

As one would say, “at the request of workers” – in the focus of the article today is a profitable deal of May! Let’s consider in detail, we will define the entry points and accompanying signals, will directly consider the dynamics of the price during the deal and find out why it was worth closing the deal exactly where it was closed.

For example, a specific profitable deal for May 4 “EUR/USD today: a pair is in anticipation of data on employment in the US”, which is included in the report from 7 to 11 May.

Signals for a deal

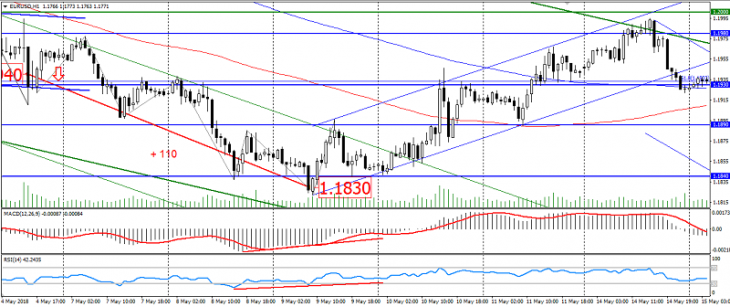

The decision to sell was made because of the persistence of a downtrend in the pair EUR/USD, which can be traced from the mid April. And coincidence with a less significant downward trend, which was traced from April 20 to May 9. It was on the last downward trend that points were formed for sale. The second confirmation signal for the sale was the breakout of the three-day lateral trend downwards. And the third factor, indicating a decline, was the formation of a “double top”, which was the reason for the resumption of the downtrend and exit from the flat.

Being in a deal

The very entrance to the deal fell on Friday, which is very unfortunate because of the high volatility that was traced this day due to the publication of the employment report in the US, as well as the fact that on Friday, often, the positions are corrected before the weekend. But these factors did not significantly affect the outcome of the deal and the correction of Monday’s Friday gave the first significant resistance level, stop – 1.1970-80.

The next two days, Monday and Tuesday, became the main days for this deal. As each day formed a new daily extremes, which in the future were the levels of support and resistance: 1.1930, 1.1900 and 1.1840. Regarding these levels, the foots were adjusted, which significantly reduced the level of risks during the trade.

Deal Profit: Closing

The signal to close the deal was the formation of a bullish divergence of the forex indicator MACD and RSI and uncertain break through the support level 1.1840. Also, you should not underestimate the overall oversold of the EUR/USD pair on the older timeframes. As a result, the deal was closed directly on the spread of the pair near the level of 1.1840 at a cost of 1.1830. The actual profit was 110 points.

As can be seen from this example, extensive technical analysis is more efficient than trading directly on one tactic. Develop different approaches to the trading with Ester Holdings!

Anton Hanzenko