Expectations from the NZD/USD pair at year’s end!

Market sentiment is changing and adapt to new factors and risks by the end of 2018. Let’s consider the expectations for the equally significant NZD/USD currency pair at the end of 2018 by analogy with the AUD/USD currency pair.

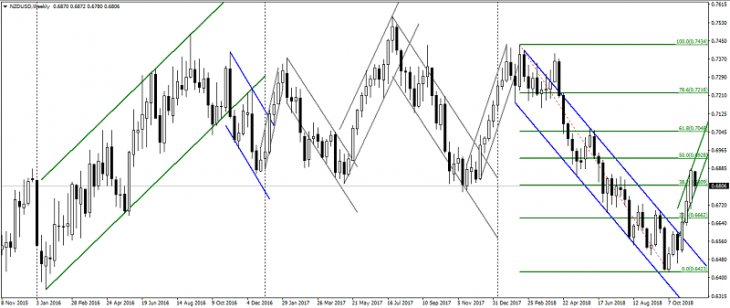

Dynamics of the NZD/USD pair throughout the year

The NZD/USD pair has been trading in a downtrend for almost 10 of 12 months, and the correctional upward dynamics it is traced since the start of November. In this upward correctional trend this pair continues to trade until now.

At the same time, with a similar analogy to the contrary, the NZD/USD pair was trading in 2016. In 2017, it is difficult to single out the one general unidirectional trend, and therefore we consider it as the year of multidirectional dynamics, which actually indicates a change in mood and uncertainty.

Figure 1. NZD/USD pair (W1) chart

The above model of movement indicates more the formation of the “head and shoulders” pattern, which refers to the reversal pattern and indicates a decline. But on the other hand, it is not clearly viewed and rather ambiguous, which is confirmed by the more rapid growth of the pair in November 2018.

What to expect from this pair

Returning to the forecast for AUD/USD, the fundamental factors of the world market will have similar effects on NZD/USD. The reduction in the US-Chinese trade tensions will support all commodity currencies, especially the currencies of the Asia-Pacific region.

From a technical point of view, the expectations are less clear. So, if we start from the annual decline and upward correction, the scenario where the NZD/USD pair will strengthen in November and December is justified by the correctional model of the market movement and will encounter significant resistance at the levels: 0.6900-30 and 0.7050. This while maintaining the existing upward dynamics.

Returning to the global dynamics of this pair and the “head and shoulders” pattern, on the contrary, we should expect the resumption of the annual downtrend. On the way of it key support levels: 0.6800 and 0.6650 are located.

As a result, we return to the fundamental factors as the main market driver. In addition to the US-China trade relations, we should not forget about the monetary policies of the world central banks. Thus, the Fed’s policy has been very aggressive for a long time, when most of the world’s central banks continue to adhere to a low-key or soft monetary policy. This factor remains a very significant fundamental indicator.

Summing up, we can say that the NZD/USD pair is more likely to grow in the shorter term, but in global expectations it will be limited to a decline.

Anton Hanzenko