Gloomy prospects for oil, should one trade on the decline?

Good afternoon, dear colleagues and co-workers of the commodity and raw materials market and its derivatives.

With you a regular connoisseur of black, yellow, white and other types of Gold –

Andrew “Golden Eye” Green.

Wednesday – the day of the publication of the weekly report from the Energy Information Administration of the US Energy Ministry (EIA) and a very good opportunity to trade on the market sentiment. And in general, the situation on the oil market is now positive for the formation of short-term trends. After data on the growth of oil reserves in the US by 3 million barrels per week, as well as the United States’s second largest oil production in the world, with an indicator of 10.28 million barrels per day, it becomes clear that the further policies of the OPEC countries and Russia to limit production volumes, as an instrument for controlling and regulating oil prices, is losing its relevance and meaning.

The main recommendation

Based on the seasonal increase in production for the spring, there is simply no way to wait for further price increases, so the main recommendation is SELL, with benchmarks close to $ 50-55.

After a short digression into the fundamental analysis, let’s analyze the technical background of the current situation in the oil market.

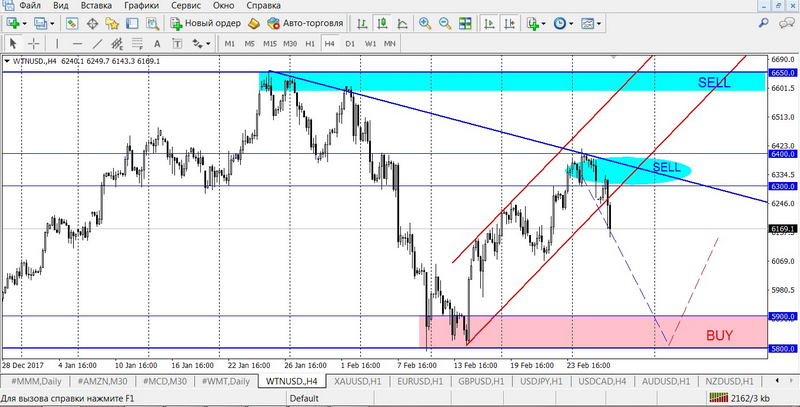

In Figure 1, we see the graph of the daytime timeframe and here the reversal consolidation of the price is clearly traced.

We have falling highs and, as yet, growing lows. For medium-term dynamics, the breakdown of the support level at $ 58 will be the main one As for reaching this level in the near future, then, as for me, this is more than real.

Let’s take a closer look at the price chart in Figure 2, timeframe H4.

As we see, a clear breakdown of the ascending short-term channel (red) has formed and a new round of downward movement is gradually forming. Confidently formed the resistance zone at 63-64.00 USD, this will be a guide for sales in the near future, with the potential to reduce the minimum to the area of 59-58.00.

Examples of transactions:

- conservative option:

BUY limit 63.50, SL 64.50, TP 59.50, - aggressive option:

BUY (current) 61.70, SL 64.50, TP 59.50.

Trade now, if the moment is obvious. Do not doubt!

Every lost profit is a loss.

Andrew Green