Opinion on the GBP/USD pair

The British pound continues to strengthen its positions against the US dollar. It is facilitated by the news that EU leaders have acknowledged that some progress has been made during the Brexit negotiations. It was also noted that the bloc should be prepared for the discussion of a trade deal with the UK, which could start operating in December. The main deterrent to achieving an agreement is the fulfillment of Britain’s financial obligations, the rights of EU citizens living in the UK, and the situation with the Irish border, after the Kingdom will leave the EU.

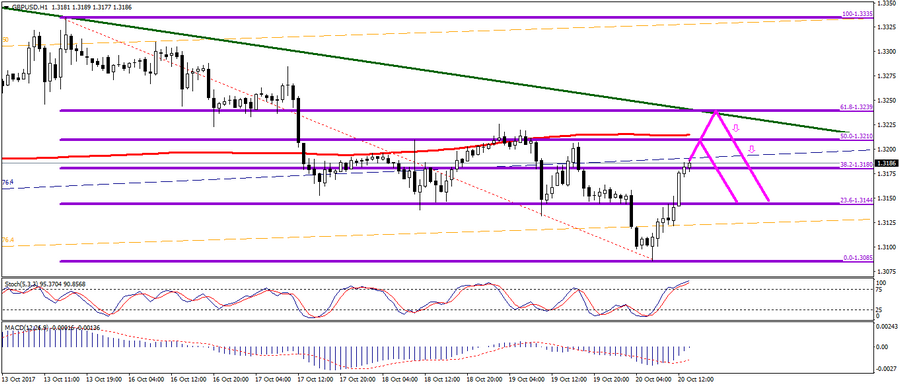

Technical analysis: At the moment the pair has reached the level of 1.3186, which is in the region of the main level of correction of Fibonacci lines on H1. In the event that the pair consolidates above the level of 1.3190, based on the support from positive news about the Brexit negotiations, one should expect a possible reversal of the downtrend in the short term.

Main recommendations: The main recommendation is still the sale of the tool. At the moment, I’m considering sales from the levels of 1.3210 and 1.3239 with a target of 1.3150, provided there are no new catalysts regarding Brexit negotiations.

Fig. Current price GBP/USD – 1.3186

Alexander Sivtsov