Opinion on the EUR/USD. Is it possible to avoid a trade war with the US

Against the background of the lack of significant news in the economic calendar, all the attention of market participants is focused on the possibility of a trade war between the US and the EU.

The precedent for trade disagreements was the decision of the US president to introduce new duties on imports of steel and aluminum. Europe is the largest steel supplier in the US, accounting for about 5 million tons of the total volume of 35 million tons per year. Today German Chancellor Angela Merkel said she wants to overcome these trade disagreements without resorting to countermeasures against the United States. In the case that the problem can not be solved through negotiations, the EU will introduce new tariffs for certain imports from the United States, and also will lodge complaint with the World Trade Organization.

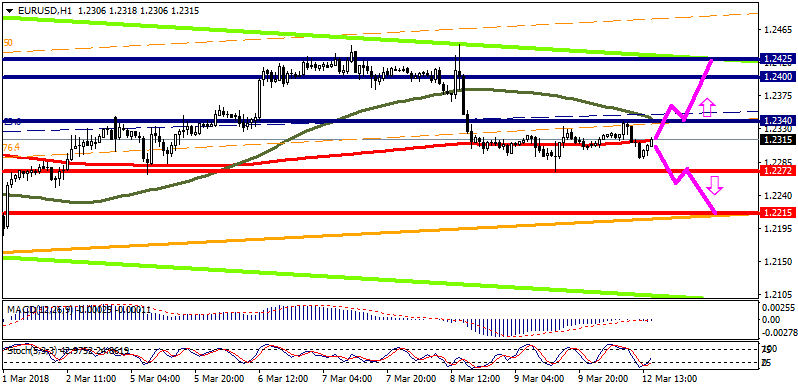

Technical Analysis: After the ECB meeting on Thursday, March 8, the EUR / USD pair moves in the flat range with resistance at 1.2340 and support at 1.22272. In case the pair will resume the decline and consolidate below the 1.22272 mark, we should expect its further decline to the level of 1.2215. If the instrument price will restored and the fixation is above the 1.2340 mark, we should expect further growth to the levels of 1.2400, 1.2425.

Fig. EUR / USD chart. The current price is $ 1.2315.

Alexander Sivtsov