The technical analysis of crypto currencies. Main differences and similarities with the foreign exchange market. Alexander Sivtsov.

In this article, we will discuss in detail the technical analysis of crypto-currencies. I will also describe how it differs from the technical analysis of currency instruments and what similarities they have.

Technical analysis of the currency in the market. Application:

To date, many sources publish articles that the market of crypto currency is significantly different from the foreign exchange Forex, in particular the use of the main elements of technical analysis. It is true, but only partially. The main engine of the movement of the price of any instrument, be it the crypto currency, stock, raw materials or the currency of any country, remains a psychology that is built on both fundamental factors and the movements in the price of the instrument. The technical analysis helps to see any potential for price movement in the market, and the psychology of market participants helps to use the same methods of technical analysis on various trading instruments, including crypto currency.

The main differences between the application of technical analysis in the foreign exchange market and the market of crypto currency.

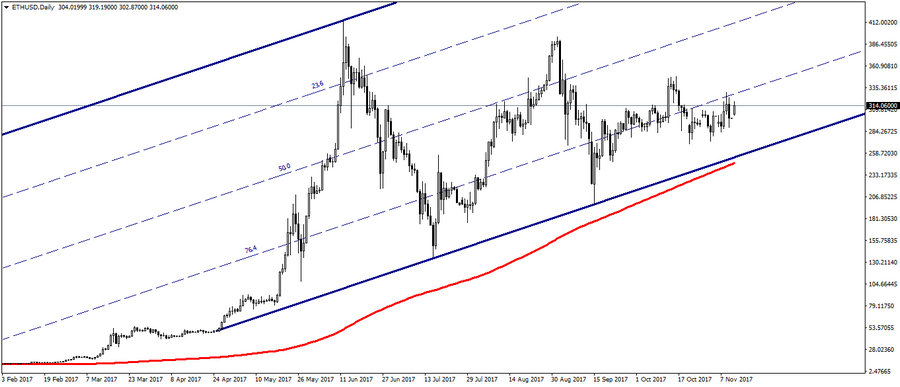

The main difference between the use of classical tools of technical analysis, namely the construction of trend lines and trend channels, is that the history of the movement of the price of the crypto currency is much shorter than the history of currency instruments. That is why it simply becomes impossible to build a number of trend channels at different timeframes. To date, the maximum timeframe on which it is possible to build a trend channel is limited to the daily interval D1.

Also read my article “Trend Channel: Rules of Building“.

The main similarities of the technical analysis of currency instruments and crypto-currencies.

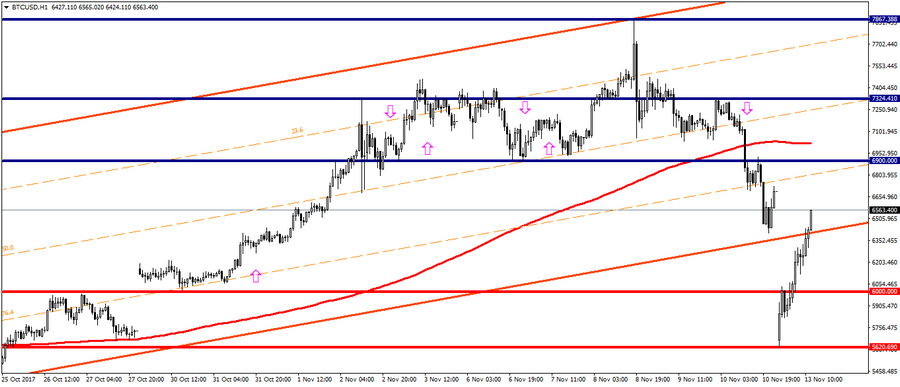

The main similarity is the price, namely the fact that the market always has a more favorable price for buying and selling, based on which the majority of market participants enters the position. At such prices that the chart shows the main price levels are indicated, which represent support and resistance areas. The price levels are divided into two categories: technical and psychological, about which you can read more in the article “Price Levels – Technical Analysis Tool“.

Price levels show themselves perfectly when trading in bitcoins and other crypto currencies, you can see this by looking at the picture below, and also following the expert’s opinions on our website.

To conclude, the classical technical analysis takes place when trading in crypto-currencies. Over the time, when the history of quotations of crypto-currency will become significantly larger, technical analysis will become more similar to the analysis of currency instruments.

Alexander Sivtsov