Emerging markets and their prospects: South African Rand (ZAR)

The concept of “Emerging Markets” has been introduced relatively recently and implies developing market economies that integrate into the world economy, but they don’t meet the standards of the world economies because of some circumstances.

Raising the theme of emerging markets and investments in them, it is worth noting South African Rand (ZAR), as one of the very promising tools for trading in the Forex currency market.

A bit about the homeland of the South African rand

South African Rand (ZAR) is the national currency of the Republic of South Africa and freely circulates in Namibia and Lesotho. Rand is a freely convertible currency and freely traded on foreign exchange markets.

South Africa (South Africa) is one of the most developed countries in the African continent. The volume of GDP of South Africa for 2015 takes 33rd place in the world according to the IMF. The main export items of this country are prone to precious metals and stones, as this country is the world leader in the extraction and export of precious and semiprecious metals. Extremely rich mineral wealth of South Africa is also rich in oil, which makes the currency of this country a raw material and dependent on the dynamics of the cost of the precious metals, oil and diamonds.

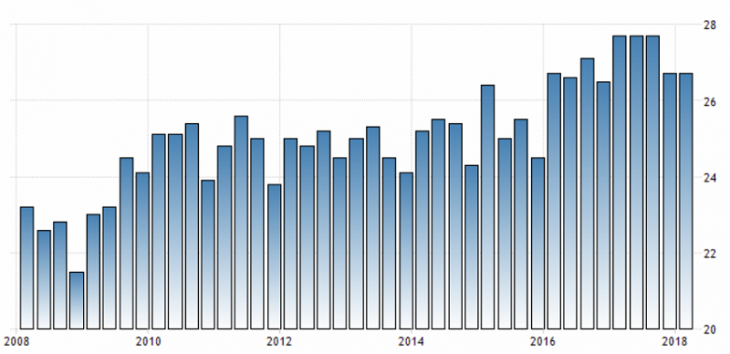

At the same time, the biggest share of South Africa’s GDP falls on the service sector, as in most countries with a developed trading economy. The main problem of the country is a very low level of employment.

Fig. 1. The unemployment rate in South Africa

Features of trading on the rand

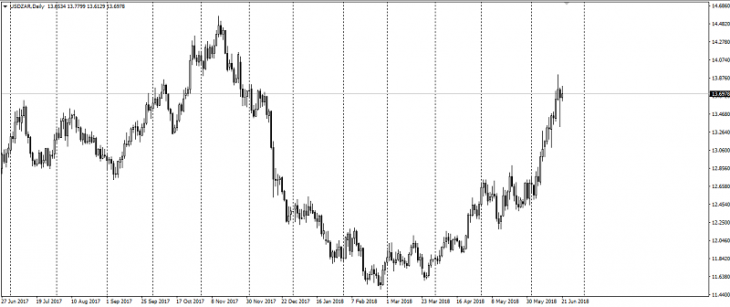

South African Rand (ZAR) has a very high intraday volatility, which is perfect for scalping. Also, because of very high volatility, it is worthwhile to plan the money-management, which should be ready for high volatility.

The pair USD / ZAR is direct and has very high volatility. Therefore, high swaps should not frighten novice investors, as intraday volatility is 1500-2500 points.

Fig. 2. The pair USD / ZAR

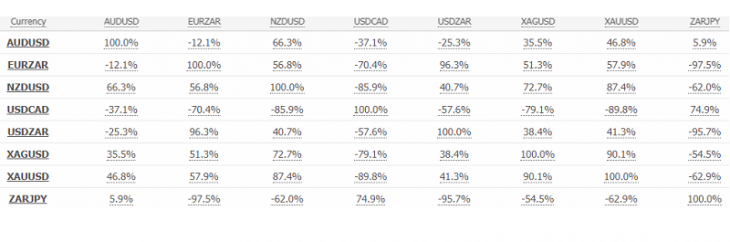

Due to the fact that rand is a commodity currency, it has a very high correlation with other commodity currencies and raw materials.

Fig. 3. Rand correlation table

Rand Analysis

The main factor influencing the South African rand (ZAR) remains the dynamics of raw materials, namely gold. Also the influence on rand is exerted by the cost of: diamonds, platinum, copper, iron and manganese.

Fig. 4. Graph of the value of USD / ZARand gold (blue line)

In addition to the fact that the ZAR commodity currency, it also responds well to relevant news: interest rates, economic indicators, etc. And since this currency has a link to gold, it reacts to common risks, sometimes acting as an asset of a safe harbor.

The main feature of the South African rand (ZAR) is its significant volatility, which, coupled with the right management, will bring profit. Also don’t forget about the very high technicality of this currency, which, together with the above features, can make rand one of the lucrative tools.

Anton Hanzenko

Many other topics are searched on the site in the Trader’s Blog!

And if you have an offer – what to write about in the next article – write to us at info@esterholdings.com!