The Japanese yen: expectations and prospects

The Japanese yen features prominently among world currencies: the US dollar, the euro, the British pound, the yen. But the yen stands out not as the classic safe haven currency, though it also remains. First of all, it is famous for its political and economic stability.

It considers the yen to a greater extent to the Canadian and Australian dollars. But in this comparison, the Japanese currency looks more confident, because the Central Bank of Canada and Australia are tend to stimulate monetary policy.

Returning to the yen, as an alternative to the dollar, euro and pound, it is worth to highlight several important factors that indicate the advantage of the Japanese currency.

Political situation

The political factor in the existing realities is the main risk factor and market driver. In most cases, it limits the development of the real economy of the country. So, the Japanese yen with political lull in the face of global political uncertainty looks like a separate planet. Given the US foreign policy with a trade war and constant pressure on the Fed. Because of what each Fed meeting can lower key interest rates in the United States. The eurozone, with a complete change of the ruling figures after the elections, retains uncertainty about the future monetary policy, which was already not particularly tough. And talking about the UK with Brexit and the political risks that it can re-exacerbate does not make sense at all.

Monetary policy

As a result, the yen looks more promising than the euro, the dollar and the pound in the face of declining general pessimism. Given the inclination of the US Central Bank, the EU and the UK to reduce the key interest rate or stimulate monetary policy – so sure. The likelihood of incentives may increase significantly after the rate cut. This will cause a chain reaction associated with stimulating the economies of other global central banks.

Economic Indicators of Japan

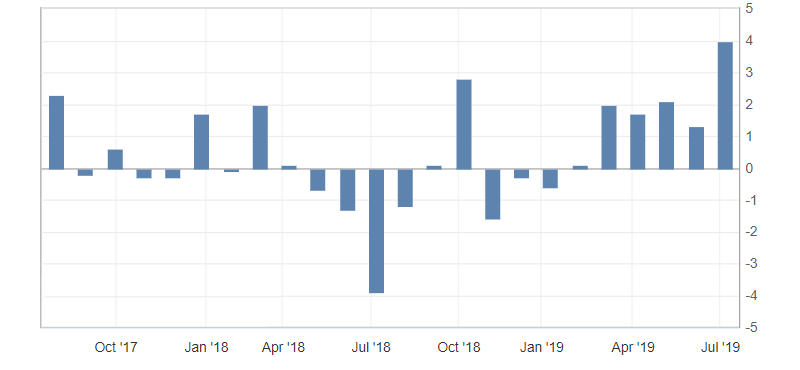

Japan’s economic indicators for June were more positive. Largely due to the data on GDP and trade balance. Less promising are household expenditures and consumer price indices. It is worth noting that indicators for household expenditures in July in Japan increased markedly. This gives a significant basis for the growth of indicators of consumer price index.

Fig. Chart of household expenditure index in Japan (y/y)

Against the background of these factors and not only the Japanese yen looks more promising than the US dollar, the euro and the British pound. A factor in the decline in demand for the yen may be a general increase in optimism associated with a decrease in the US – China trade tensions.

Anton Hanzenko