Fundamental analysis: Inflation and the impact of its indicators on world currencies. 1/2

Continuing the cycle of articles of fundamental analysis and directly economic indicators, we will consider the topic: “Inflation and the impact of its indicators on world currencies”. Earlier, an example of the impact of employment on currencies was examined, where we learned about the main concepts and connections and what should be paid attention to when analyzing the employment report.

This article will focus on inflation and its role in the value of the currency. First, let us consider the basic concepts that we will meet.

Basic concepts

Inflation is the direct change in the price of the same product or service over time. Inflation is both positive and negative. Negative inflation is called deflation.

Inflation in terms of growth or nominal value is divided:

- Moderate inflation is up to 10%. But this is not an obligatory indicator for the normal development of the economy. In most countries with developed economies, the inflation rate is estimated at 2%.

- Hyperinflation is more than 100%, prices are rising very fast, thereby completely depreciating the value of money. This is usually caused by a crisis or war.

- Deflation is negative inflation. Deflation is a negative process for the economy.

Why deflation is bad?

In the era of market economies, negative inflation (deflation) indicates the freezing of the cost of goods or services, which eventually leads to a deficit and price destabilization, which is unacceptable for this type of economy. With weak inflationary pressures, central banks will not be able to tighten monetary policy, so the national currency will remain under pressure against its main competitors.

In addition, most countries have a national debt and it is easier to give it away with a more depreciated currency.

What determines inflation

Inflation is also called the “price index”, because inflation determines the price and vice versa. Inflation and price in principle are inseparable. Since the definition of the level of inflation is a very complex process, it is assessed by several key indicators.

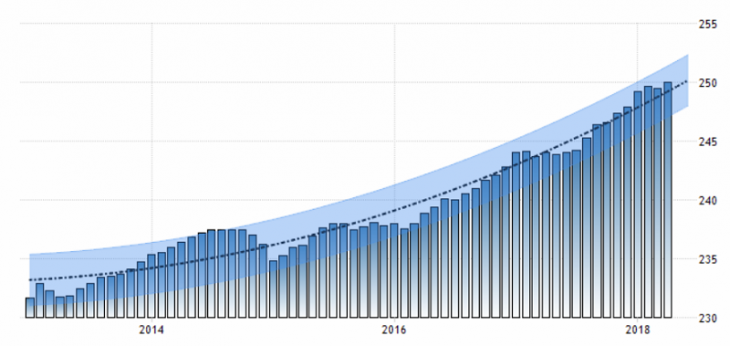

The consumer price index (CPI) is a measure of the value of the consumer basket, which includes both goods and services. The CPI is one of the main indicators of inflation in the country.

Fig. 1 .: US CPI

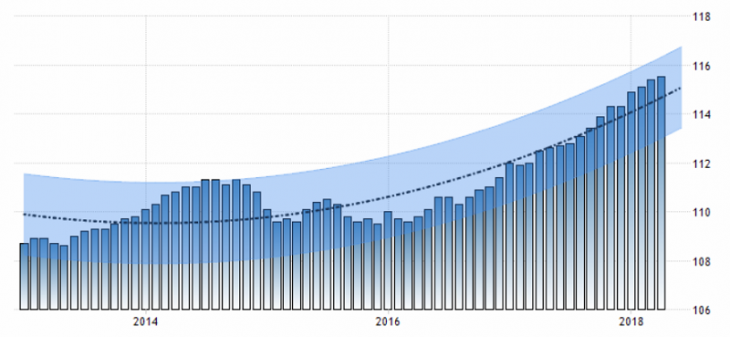

Producer Price Index – displays the wholesale prices of producers in a period of time.

Fig. 2. US Producer Price Index

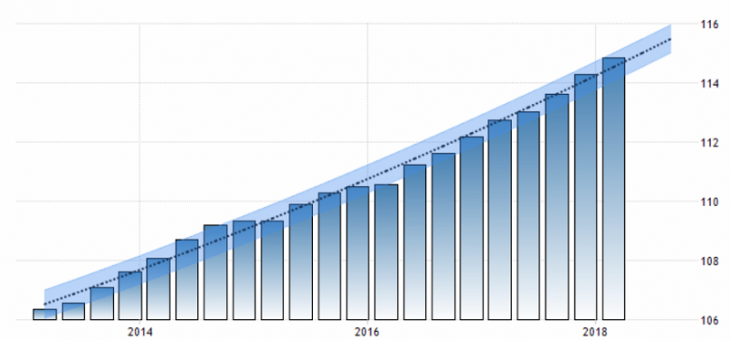

The GDP deflator is the ratio of nominal GDP to real GDP.

Fig. 3. US GDP deflator

In the next part of this article, we will consider the impact of the above-mentioned indicators and inflation on the exchange rate.

Anton Hanzenko