IBM – old, but not rusty: big expectations for the quarterly report.

Hello to all participants of the continuous market and users of remote access to the opportunities and tools of the New York Stock Exchange.

With you, Andrew Green is a zealous adviser and an active stock trader.

We continue our review with recommendations on the most interesting reports of the US stock market.

And today, under our close attention is the mastodon of the computing sector and the progenitor of the modern industry of personal computers and components – International Business Machines (NYSE: IBM).

For the last 6 years the company has been struggling with negative profit dynamics, and finally after such a long wait we see a forecast for the growth of this indicator in the region of 0.7% per annum.

Since 2000, IBM has focused on providing consulting and analytical services, gradually moving away from the direct production of hardware. Occupying an active position in the market of information technology services, Big Blue (one of the informal nicknames of IBM) in 2017 buys the company’s 20-th in the field of information security – Agile 3 Solutions, developer of software for risk management related to sensitive data in the corporate environment.

In early 2017, an alliance was concluded between IBM and Salesforce, in which both companies will jointly promote forecast analysis tools, and IBM’s Watson system will connect the artificial intelligence platform Salesforce Einstein, which will help to better understand and use the generated analytical information for the benefit of the business in the field of sales.

To develop only one cloud service Watson Health Cloud, IBM spent more than $ 4 billion on the purchase of IT-companies from the health sector, for example, in February 2016, IBM acquired for $ 2.6 billion Truven Health Analytics – offering management information and analysis services to healthcare institutions , state authorities and insurance companies.

In March 2017, IBM announced the project IBM Q – to create the world’s first universal quantum computer, access to resources which will be provided through the cloud platform IBM Cloud. It is planned that within a few years a universal quantum computer system will be created to fulfill the tasks of developing new medicines, advanced materials, research in the field of artificial intelligence, digital security, logistics and financial services.

In November 2017, IBM scientists successfully built and measured a prototype processor with 50 quantum bits.

(source Wikipedia)

In my opinion, a person who likes to read science fiction and see tales of the future, this company is moving very much even in the right direction. As for the negative dynamics of profit, everything is quite simple, the company’s management has more strategic expectations than just the current profit indicators. But, of course, one must have a sober view of things, namely: to implement such full-fledged ambitions for global development in the field of future information technology, it is necessary to have a lot of money, and market support and market capitalization are a very necessary part of the company’s development strategy.

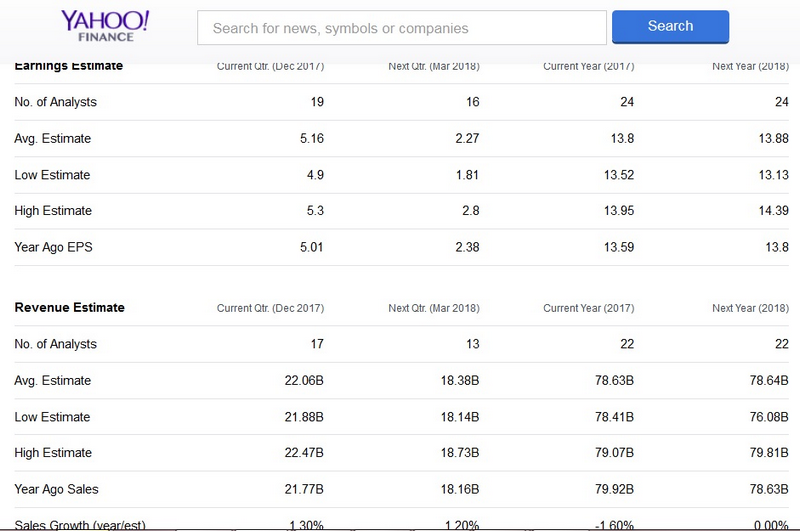

What we expect from the report in absolute terms:

- Revenues: $ 21.94 billion;

- Earnings per share: $ 5.16.

No less interesting, besides the report itself, there will also be comments on it, and I would like to see a more concrete and optimistic picture on the positive prospects and reasons for further enrichment of shareholders and shareholders of the company.

Trade recommendation for this company: here it is worth waiting until the report is released and act after its official publication.

Everything is quite simple, having received confirmation of the forecast indicators – we buy, negative – we trade for a decrease. The market reaction to the output of the report is expected to be rather strong.

In order to understand more specifically the tactics of trading on this kind of events, let’s look at a few graphs of this financial instrument (Figure 2):

Here, on the weekly timeframe, as you can see, everything looks good – a clear reversal of the downtrend, with the breakdown of the resistance line and the formation of an upward trend.

But since we are going to trade for shorter periods, we go deeper and dive to the periscope depth for stock traders – the daily timeframe.

We consider two optins of development:

- Positive news. Of course, for us the main transaction is BUY, and the potential for movement on the positive news is the resistance area around 180 USD.

- Negative news. Then, short the position to 150 USD.

In general, I personally sympathize with the policies that are followed in the company’s board, and long-term expectations for IBM – to keep, and in case of publication of even negative reports, there is a desire to consider long-term purchases from the zones of 150-130 USD, of course, under condition of formation of a stable signal to a turn.

For those who continue to learn the wisdom of the exchange trade, you can learn more about the reversal signals and continuation of the movement on our individual training courses on the Ester Holdings inc website.

In general, everything is quite obvious, so we expect the official release of data on the company.

And remember: We earn only when we trade!

Andrew Green