Euro remains under pressure: Retail sales growth does not help

The single currency continues trading under pressure against the US dollar, despite the growth of retail sales in the euro area. See the Market News. In general, the decline in the EUR/USD is due to the multidirectional monetary policy of the ECB and the Fed. The eurozone’s QE program was extended by the decision of the ECB until September 2018, while the Fed is approaching another tightening of monetary policy.

Also today, in his speech, Mario Draghi noted the preservation of the problem in the banking sector of the eurozone, which is associated with bad loans in large banks of the region. The head of the ECB stressed that, despite the fact that over the past two years the percentage of bad loans in large banks has declined, many banks still do not have the opportunity to absorb large losses.

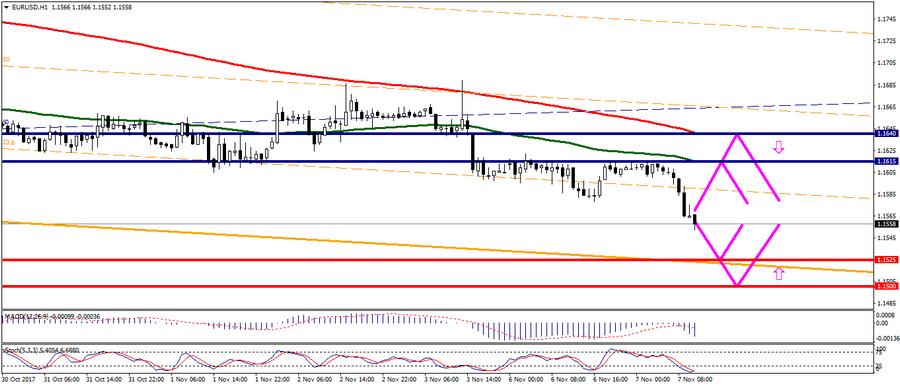

Technical analysis: Because of the today’s decline, the pair EUR/USD has updated the minimum for the last 16 weeks. One should consider the main support levels at 1,1525; 1,1500.

Fig. Chart EUR/USD current price – 1,1558

Alexander Sivtsov