EUR/USD today: the market is waiting for NFP

On Friday, the pair EUR/USD is traded in different directions, near the highs of September last year, and not having received the proper development of the movement due to the expectation of publication of the employment account in the United States (NFP). As a result, expectations on Thursday were canceled due to fundamental factors.

Events for today:

- 15:30 – publication of the US employment report: the average hourly wage in the US (m/m), the change in the number of non-farm workers, the proportion of the economically active population in the US, the change in the number of people in the private non-agricultural sector and the unemployment rate in the US.

- 17:00 – data on the US: the volume of orders for durable goods in the US (m/m), the volume of industrial orders (m/m), the index of employment in the non-manufacturing sector (ISM) and the index of business activity in the non-manufacturing sector (PMI) by ISM.

The day is full of data on the US, but the mainly the market will be focused on the report on employment in the US.

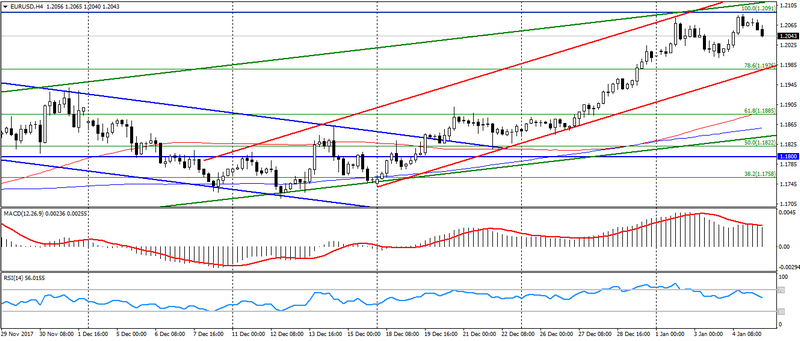

The EUR/USD remains limited to the September high of last year at 1.2100, which as a result may hamper the further growth of the pair. The main driver of this pair and the market as a whole is the forthcoming report on the US, expectations about which will come later.

Given the technical picture and the unpredictability of the report on employment in the US, one should expect several development options for the events.

- Based on positive data on employment, the US currency will accelerate the recovery and cast doubt on the safety of the uptrend. As a result, one should expect a support test at the levels: 1.1980 and 1.1950. At the same time, the overall two-month trend for the pair will persist, having received an excuse for correction to the levels of 1.1900 and 1.1860.

- Flat employment data on the US will strengthen the upward trend and will open the way to the levels: 1.2100 and 1.2130-40, which will indicate the possibility of breakthrough the existing resistance. In this case, the pair will be limited to a significant overbought, and as a result the correction is possible.

In case of ambiguous data, it is necessary to expect multidirectional fluctuations in the range from 1.1980-1.2000 to 1.2100-30. At the same time, one should expect the maintanance of the uptrend in the pair EUR/USD.

Fig. EUR/USD H4. The current price is 1.2040.

Hanzenko Anton