EUR/USD today: the pair keeps a downward trend

Yesterday’s expectations regarding the closure of the gap were not justified, the EUR/USD pair updated Monday’s low at 1.1830 and maintained a downtrend. The reason for the fall in the pair was the persistence of unjustified Germany and the Brexit negotiations, but also do not forget about the risks associated with the United States. But, the market focused on selling the euro.

Events for today:

- 15:15 – release of a change in the number of people employed in the non-agricultural sector of the US by ADP.

- 15:30 – a news block on the US: the level of productivity in the non-agricultural sector of the United States (q/q) and labor costs in the US (q/q)

- Also, at 15:30 – publication of the labor productivity in Canada (q/q).

- 17:00 – announcement of the results of the meeting of the Bank of Canada.

- 17:30 – release of the oil reserves in the USA.

In addition to the existing risks, the market is preparing for Friday’s report on employment in the US, but before this will be released the number of employees in the non-agricultural sector of the US by ADP, which will affect the expectations of the employment market in the US. Also, today will be publication of a report of the Bank of Canada, which may have an impact on the American.

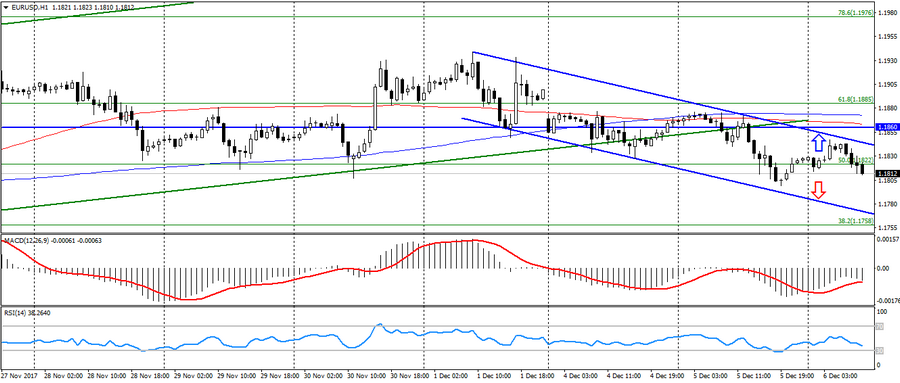

Despite the continued downtrend in the pair EUR/USD, the pair remains limited to support level 1.1820-00, which is the minimum of last week. In case of breaking through this level, one should expect further reduction to support levels: 1.1770-80 and 1.1740-50. But the return of the price above 1.1850-60 will cancel the scenario for the decline and resume expectations for strengthening the pair to resistance levels: 1.1880 and 1.1900. The market remains very volatile due to upcoming news and political risks.

EUR/USD chart. The current price is 1.1810.

Hanzenko Anton