EUR/USD today: the pair is maintaining a negative attitude!

At tradings on Tuesday, the pair EUR/USD fully met expectations, which was supported by pressure on the euro through the cross EUR/GBP. Tradings on Wednesday opened under pressure of correction, which was caused by the weakening of the American on the resumption of geopolitical risks on the Korean peninsula. As a result, the pair EUR/USD remains trading below the level 1.1880.

Events for today:

- 15:00 – publication of the consumer price index (CPI) in Germany (m/m).

- 15:30 – preliminary data on the US GDP.

- 16:00 – the speech of the head of the Bank of England, Carney.

- 17:00 – the speech of the head of the Fed Chairman, Yellen.

- Also, at 17:00 – announcement of the index of unfinished sales in the US real estate market (m/m).

- 19:00 – the speech of the President of the Bundesbank, Weidmann.

- 21:00 – publication of the “Beige Book” of the US Federal Reserve.

The day is full of news and speeches by representatives of the world’s Central Bank, which can cause outbursts of volatility. Also, the market monitors the negotiations between the EU and the UK regarding Brexit. Therefore, the dynamics of the pair EUR/USD will largely depend on the cross-rate EUR/GBP.

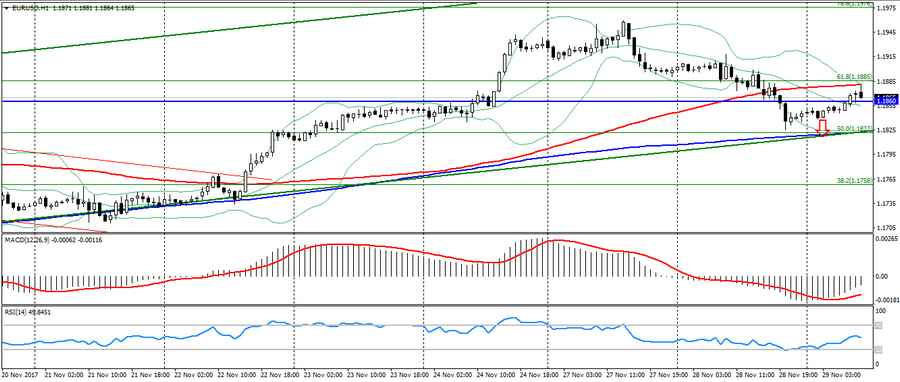

The EUR/USD is trading in a downtrend and is limited by resistance level 1.1880-1.1900, from which one should expect the resumption of the downward dynamics. Support is located at the levels: 1.1820-30 and 1.1800. Given the upcoming news and a monthly uptrend, it is possible that the euro will resume its growth when the pair is fixed above 1.1880-1.1900. In this case, the scenario for the reduction is canceled and one should expect the update of the recent highs at the levels of 1.1940 and 1.1960-70.

EUR/USD, current price – 1.1870

Hanzenko Anton