EUR/USD today: the pair is in uncertainty

After yesterday’s EUR/USD growth on weak data on sales of new housing in the US, this pair, like the American as a whole, remains clamped in a sideways trend. As a result, yesterday’s expectations regarding the flat were justified. This movement is also facilitated by the uncertainty in the market regarding upcoming US data.

Events for today:

- 15:00 – release of the consumer price index (CPI) of Germany (m/m) (Feb).

- 15:30 – data on the USA: basic orders for durable goods (m/m) (Jan), volume of orders for durable goods (m/m) (Jan) and foreign trade balance (Jan).

- 16:00 – Composite index of the cost of housing S & P/CS Composite-20 will be released without seasonal fluctuations (y/y) (Dec).

- 17:00 – release of the CB consumer confidence index (Feb).

- Also, at 17:00 – the speech of the head of the Federal Reserve Powell.

Today is full of statistics on the US, among which is worth mentioning data on durable goods. The market also awaits the appearance of Powell. This is his first appearance as the head of the US Federal Reserve. The hints regarding the US monetary policy are expected from this speech.

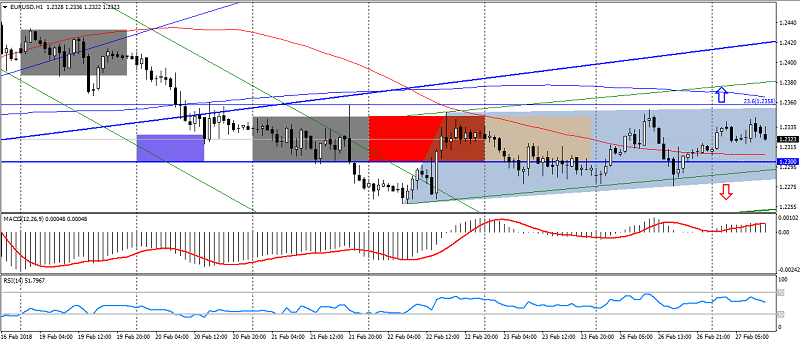

Uncertainty in the market indicates the transition of investors to the awaiting position ahead of the US data. Therefore, it is also worthwhile to refrain from transactions before the release of the US data and the pair’s exit from the established trading range. Support levels: 1.2300-1.2270 and 1.2250, resistance: 1.2350-60 and 1.2400-40.

Fig. EUR/USD. The current price is 1.2320.

Hanzenko Anton