The US dollar remains under pressure. Data on sales of new housing in the US

The US dollar continues to exert pressure on the main competitors, despite the weak data on sales of new housing in the US.

- According to published data, in January, the sale of new housing fell to the level of 593 thousand, against the previous value of 0.643 thousand. As a percentage, the decline was -7.8%, exceeding the previous decline of -7.6%.

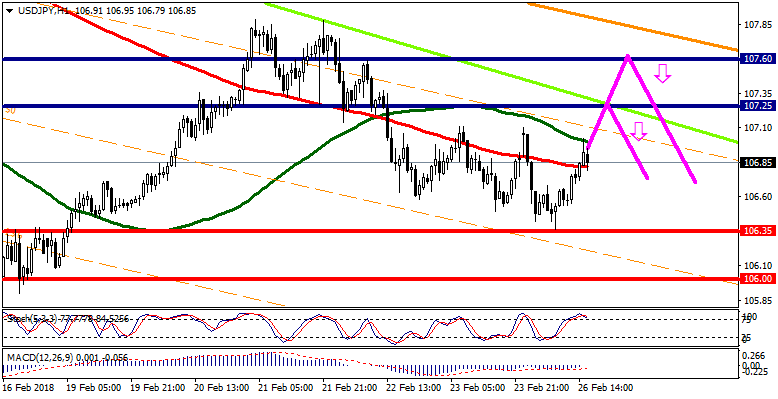

Technical Analysis: Despite the strengthening of the US dollar, the pair USD/JPY keeps the downtrend in the short term. The nearest levels of resistance are 107,25, 107,60. The support levels are 106.35, 106.00.

Key recommendations: The main recommendation will be the sale of USD/JPY instrument, which is indicated by the Stochastic Oscillator about overbought of the instrument. It is recommended to enter the deal with the corresponding signal of the indicator on H1, namely when movings are crossing the level 75 from top to bottom, and the candle should be closed at this time. More secure will be the entry from the above mentioned resistance levels of 107.25, 107.60, with the potential to reduce 40-50 points, but not below the area of 106.35-106.00.

Fig. USD/JPY. The current price is $ 106.85.

Alexander Sivtsov