The UK data

The block of statistics on the UK was very mixed.

- The volume of manufacturing in the manufacturing industry in the UK rose 0.4% in November, indicating a fifth consecutive month of growth, which, amid a general decline in activity in the UK due to Brexit, indicates a very optimistic dynamic.

- The trade balance of the UK maintains a downward trend and amounted to -12.23D, which indicates the continued downward dynamics of this indicator. As a result, data on the UK appeared to be restrainedly negative.

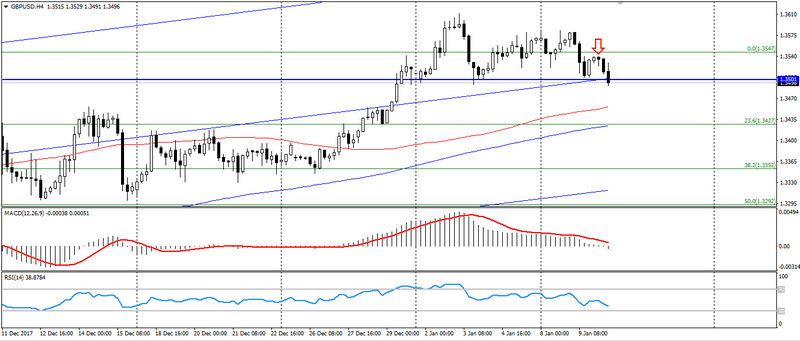

Given the preservation of pressure from the US currency and the Japanese yen, the pound will continue to decline across the entire spectrum of the market, but especially against the yen and the American. Thus, the pair GBP/USD maintains the correction phase and will be limited to support levels: 1.3480, 1.3450 and 1.3430.

Fig. GBP/USD H4. The current price is 1.3490.

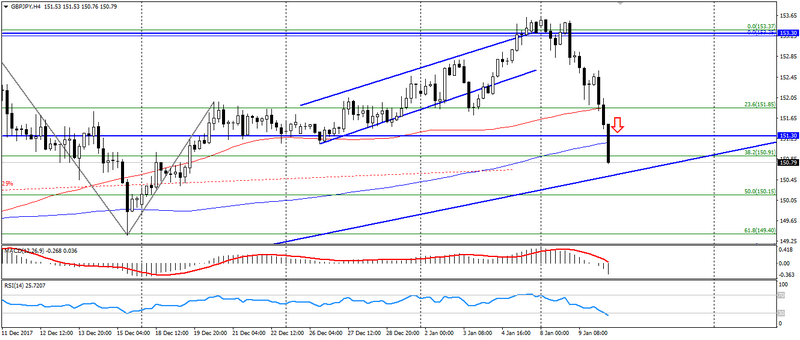

The GBP/JPY cross-rate is more prone to decline due to the growth of the Japanese currency. But this pair will also be limited to levels of support and oversold: 150.60, 150.30 and 150.00.

Fig. GBP/JPY chart H4. The current price is 150.80.

Hanzenko Anton