U.S. data

- GDP (q/q) (Q1), fact 3.1%, forecast 3.1%.

- GDP deflator (q/q) (Q1), fact 0.5%, forecast 0.6%.

- Goods trade balance (Apr), fact -72,12B, forecast -72,00B.

- Initial jobless claims, fact 215K, forecast 216K.

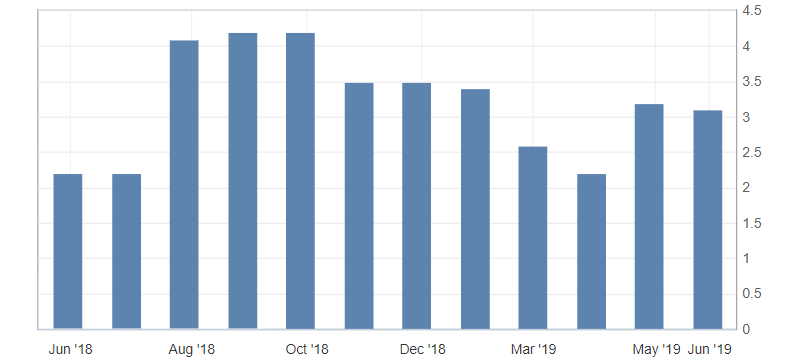

Published data on the United States turned out to be very ambiguous. Preliminary data on the US GDP showed a slight slowdown, which corresponded to the forecast. At the same time, GDP growth rates remained above 3%, which is a very positive signal for the economy. The negative note of the report was the data on the GDP deflator, which pointed to the continuation of a slowdown in expected inflation. On the other hand, the decline in the number of initial claims for unemployment benefits declined, with restrained support for the American dollar.

Fig. 1. The US GDP chart

In response to ambiguous US data, the market response was similar. Thus, the US dollar index reacted with quite restraint to the published data and showed multidirectional dynamics. In fact, he remained traded in the trading range of the day, limited to the resistance of 98.20. With the upward trend in the dollar and the current market sentiment maintained, we can expect continued growth of the American dollar against a basket of competitors. The following resistance continues to be significant resistance: 98.20 and 98.30, support: 98.10 and 98.00.

Fig. 2. The US dollar index chart. The current price is 98.10 (10-year US government bonds yield is the blue line)

Read also: “Discount rate. Analysis of changes in interest rates

based on economic indicators “

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Political risks in the UK increase the chances of Brexit without a deal

- Cryptocurrencies as new safe haven assets

- The impact of the trade war on the US stock market

Current Investment ideas: