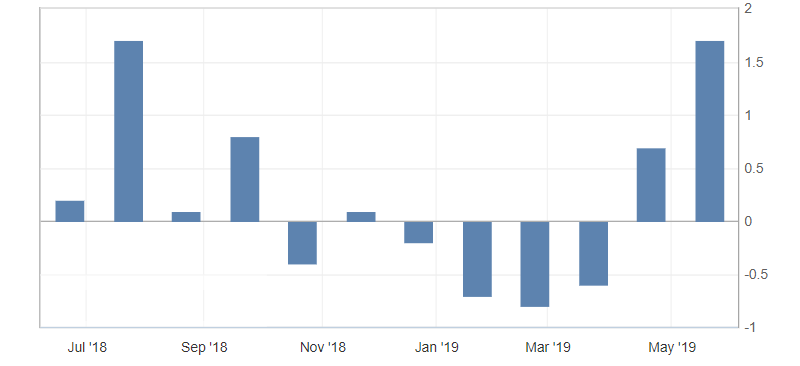

Canadian Retail Sales

- Core Retail Sales (m/m) (Mar), fact 1.7%, forecast 0.9%.

- Retail sales (m/m) (March), fact 1.1%, forecast 1.0%.

Retail sales in Canada rose to their maximum over the last year, providing significant support to the Canadian dollar, reinforcing expectations for inflation in the country.

Fig. 1. Core retail sales index (m) chart in Canada

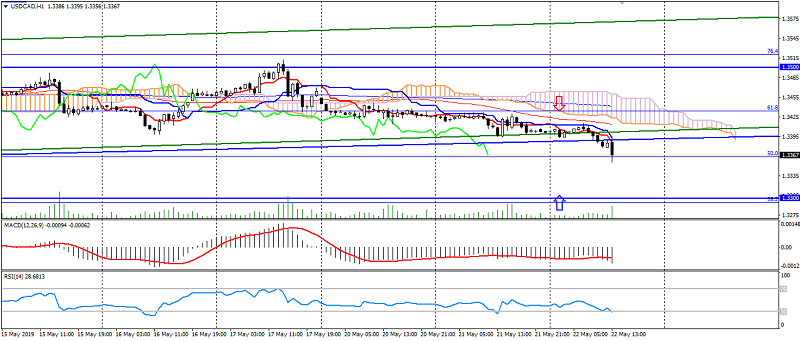

In addition to the growth of the Canadian dollar, the pressure on the USD/CAD pair is largely due to the sale of the US dollar. This is due to risk aversion and increased demand for safe harbor assets. The USD/CAD pair has updated a low at 1.3360, thus leaving the side channel of the last weeks and completely breaking the upward monthly trend. Further decline in the pair will be limited to support levels: 1.3330 and 1.3300. Resistance is located at the levels: 1.3400 and 1.3430.

Fig. 2. USD/CAD chart. Current price – 1.3360

Read also: “5 useful trader habits”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- The impact of the trade war on the US stock market

- Expectations from the AUD/USD pair for May

- Escalation of the US-China trade war and what it means for the market

Current Investment ideas: